Renewable Energy for Economic Development

Job Creation and Economic Diversification

Strategies for Generating Employment

One of the most pressing challenges in economic development is establishing diverse employment opportunities. Success in this area demands forward-thinking initiatives that nurture creativity and business ventures, paving the way for novel industries to emerge. Special emphasis must be placed on supporting small and mid-sized businesses, as these enterprises typically serve as the primary engines of employment generation, especially in developing sectors.

Legislative measures should encourage corporate investment in research initiatives through benefits like tax incentives, financial assistance, or direct funding for firms engaged in pioneering new market solutions.

Strategic Industry Growth

Broadening economic foundations requires concentrated efforts on cultivating industries that complement regional assets and capabilities. This process involves pinpointing promising fields, developing specialized labor forces, and attracting capital to these domains.

Establishing fundamental infrastructure and auxiliary industries that serve as critical support systems for targeted sectors proves equally vital. Such development might encompass enhancements to transport systems, digital networks, and essential utilities.

Cultivating Professional Expertise

A competent and versatile workforce stands as the cornerstone of economic expansion and employment generation. This necessitates substantial commitment to educational initiatives that prepare individuals for tomorrow's professional landscape. Continuous training programs remain indispensable for equipping current workers with the capabilities demanded by evolving industries.

Attracting International Capital

Foreign investment serves as a powerful catalyst for economic transformation. Beyond financial infusion, this investment brings cutting-edge technologies, management methodologies, and specialized knowledge.

Developing an appealing investment climate requires simplifying administrative procedures, upgrading fundamental facilities, and maintaining steady political and economic conditions. These elements can dramatically increase a region's attractiveness to international investors.

Infrastructure Modernization

Advanced physical networks form the backbone of economic progress and diversification. Contemporary transport solutions, dependable communication infrastructure, and efficient utility services prove fundamental for business attraction and commercial exchange. Capital investment in foundational projects like highway systems, seaports, and aviation facilities remains crucial for boosting productivity and market competitiveness.

Fostering Business Innovation

Encouraging new business ventures remains pivotal for driving sector innovation and employment generation. This includes providing financial access, expert guidance, and professional networking for aspiring business owners. Establishing nurturing environments for emerging companies and small enterprises proves essential for generating economic vitality and sector variety.

Collaborative Regional Approaches

Economic expansion benefits significantly from cooperative regional strategies. Pooling resources, knowledge, and successful methodologies across geographical boundaries can accelerate industrial development and create employment opportunities for all participants. This cooperative method builds reciprocal support systems and generates a more resilient and interconnected economic framework.

Emerging Investment Prospects and Technological Progress

Capital Allocation in Cutting-Edge Technologies

Breakthrough innovations including machine intelligence, biological engineering, and sustainable power solutions present remarkable investment potential for those seeking substantial returns. These fields are witnessing accelerated development and technological breakthroughs, driving progress across multiple industries. Strategic investment in these domains can provide access to future industry leaders and revolutionary technological solutions. Comprehensive market analysis and thorough understanding of associated risks remain prerequisites for successful capital allocation.

Additionally, the potential for industry transformation and market dominance in these developing sectors remains exceptionally high. Nevertheless, investors should recognize that market volatility and unpredictability in these areas can be significant. Grasping market forces and recognizing potential obstacles remains fundamental for making sound financial decisions.

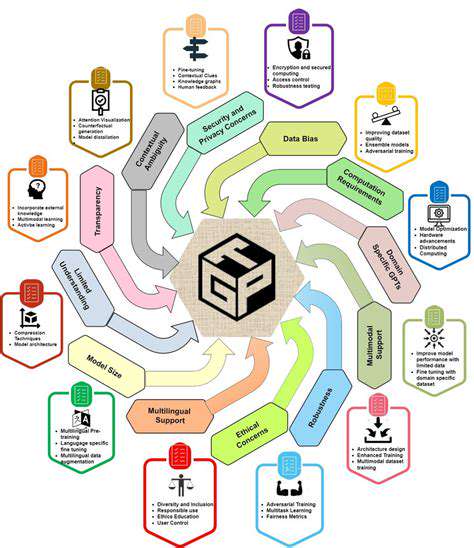

Intelligent Systems in Financial Markets

Advanced computational systems are fundamentally altering financial landscapes, offering improvements in investment methodology, automated transactions, and sophisticated risk assessment. These analytical tools can process enormous datasets to detect patterns and forecast market movements, potentially yielding more informed capital allocation decisions. This represents a crucial domain where technological solutions can optimize efficiency and potential investor returns.

The evolution of complex analytical models capable of interpreting multifaceted financial information promises to transform traditional investment approaches. However, verifying the dependability and precision of these models remains essential before basing critical financial choices on their outputs.

Biological Innovations Transforming Healthcare

Biotechnological advancements are revolutionizing medical treatment and pharmaceutical development, addressing critical health challenges while offering substantial investment potential. From genetic modification techniques to customized medical approaches, this sector leads advancements in diagnostic methods, therapeutic solutions, and preventive healthcare. While offering high return potential, investors must consider regulatory complexities and extended development timelines for novel treatments.

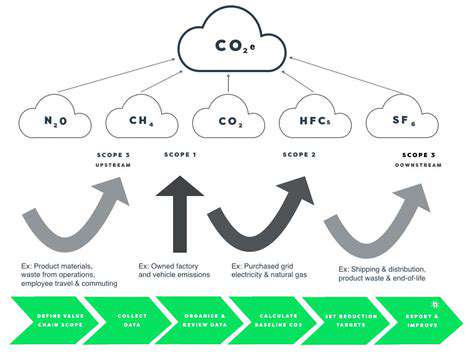

Sustainable Energy Investment Potential

Growing global emphasis on environmental sustainability is driving significant investment in alternative energy solutions. Solar, wind, and similar sustainable technologies are achieving cost parity with conventional fuel sources, creating attractive prospects for capital deployment. This sector presents opportunities to participate in rapid market expansion while supporting environmental conservation efforts.

Furthermore, government incentives and policy frameworks designed to promote clean energy adoption continue to accelerate industry growth. Nevertheless, factors including energy price fluctuations and technological evolution require careful monitoring.

Principles of Responsible Investing

Conscientious investment combines financial objectives with environmental and social considerations. Investors increasingly seek opportunities that reflect personal values while contributing positively to societal and planetary wellbeing. This methodology can yield both financial benefits and meaningful social impact.

Ethical factors play a central role in this investment philosophy. Investors must critically analyze the broader implications of capital allocation to verify alignment with core principles. This demands meticulous research and comprehensive understanding of potential investment consequences.

Infrastructure Expansion and Energy Reliability

Infrastructure's Role in Energy Assurance

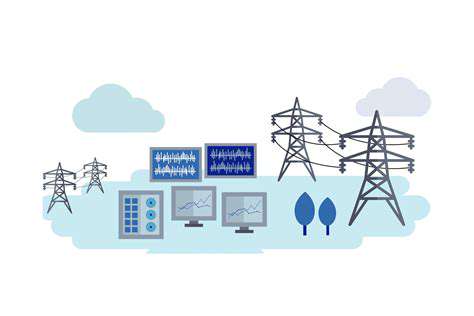

Reliable infrastructure proves critical for efficient delivery of clean energy solutions. This encompasses transmission networks, power distribution systems, storage facilities, and delivery channels. Without robust infrastructure foundations, the advantages of renewable energy including solar and wind solutions may be substantially limited. Well-planned and maintained physical networks guarantee consistent clean energy supply, reducing dependence on unpredictable fuel markets and enhancing energy independence.

Developing nations frequently encounter substantial infrastructure challenges during their transition to clean energy solutions. Overcoming these barriers proves essential for achieving sustainable economic progress and improving quality of life. Capital investment in construction projects, including establishing new networks and modernizing existing systems, remains crucial for effective renewable energy integration and long-term energy security.

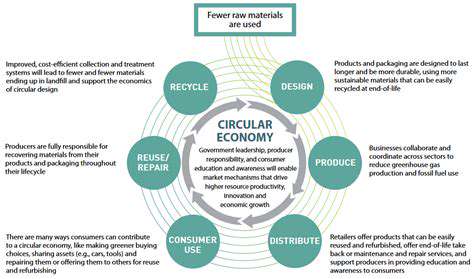

Renewable Energy's Economic Implications

The establishment of renewable energy infrastructure not only strengthens energy security but also stimulates economic activity. New employment emerges in production, implementation, upkeep, and research related to clean energy technologies. This commercial activity drives innovation and technological progress, leading to further economic evolution and resilience.

Moreover, decreased reliance on conventional fuel sources can redirect resources to other economic segments. This may result in enhanced productivity, improved living conditions, and more sustainable economic models.

Grid Modernization for Renewable Integration

Upgrading existing electricity networks to accommodate renewable energy variability represents a critical step in ensuring dependable energy provision. Intelligent grid systems incorporating data analysis tools prove essential for managing solar and wind power fluctuations. These advanced networks enable optimized energy distribution while providing superior control and management of power flows.

Storage Solutions for System Stability

Energy preservation technologies play a crucial role in guaranteeing renewable energy system reliability. Storage methods including advanced batteries and hydroelectric storage systems prove essential for managing renewable power intermittency. By conserving surplus energy during peak production periods, these technologies enable consistent energy provision during low production phases.

Financial Considerations for Infrastructure

Appropriate funding and capital allocation prove crucial for renewable energy infrastructure development. Attracting both public and private investment remains essential for supporting required capital expenditures. Government incentives, tax benefits, and transparent regulatory structures can stimulate infrastructure investment, creating favorable conditions for development. Collaborative public-private arrangements may also contribute significantly to resource mobilization and knowledge sharing.