Global Trends in Corporate Renewable Energy Sourcing

The Rise of Corporate Renewable Energy Sourcing

Driving Forces Behind the Shift

Businesses worldwide are rapidly embracing renewable energy solutions, influenced by multiple converging factors. Consumer and investor expectations regarding environmental responsibility now heavily influence corporate decisions. Governments worldwide are rolling out stricter regulations, including carbon pricing mechanisms and mandatory emission cuts, making renewables increasingly attractive. Beyond compliance, companies are discovering tangible financial benefits, from reduced operational expenses to enhanced market positioning through sustainability credentials.

Technological breakthroughs in solar, wind, and storage systems have dramatically improved affordability and reliability. These advancements, combined with supportive policies in key markets, create a virtuous cycle accelerating adoption across industries. Small and medium enterprises now find renewable solutions within reach, thanks to modular technologies and innovative financing models.

The Role of Investor Pressure

Modern investment strategies prioritize transparency in environmental performance metrics. Shareholders demand detailed reporting on renewable energy commitments and measurable progress toward sustainability targets. ESG-focused funds now outperform traditional portfolios, prompting corporations to align their energy strategies with investor expectations or risk capital flight.

The growing emphasis on sustainable finance directly impacts corporate energy decisions. Firms lagging in renewable adoption face higher capital costs and reduced access to growth funding. Consequently, clean energy procurement has evolved from a compliance exercise to a core financial strategy component influencing valuation multiples.

Technological Breakthroughs and Cost Economics

Solar photovoltaic costs have plummeted 82% since 2010, while onshore wind power prices dropped 40% in the same period. These dramatic reductions make renewables cost-competitive with fossil fuels in most global markets without subsidies. Simultaneously, battery storage costs fell 89% from 2010-2020, solving intermittency concerns that previously hindered adoption.

Supply Chain Sustainability Initiatives

Forward-thinking corporations now mandate renewable energy use throughout their supplier networks. This cascading effect transforms entire industries, as tier-one suppliers require similar commitments from their own vendors. The result is an accelerating domino effect pushing clean energy adoption deeper into global value chains.

Policy Landscapes and Market Signals

Governments wield significant influence through carefully designed policy instruments. Production tax credits, accelerated depreciation schedules, and renewable portfolio standards create predictable investment environments. Clear, long-term policy frameworks reduce risk premiums and attract institutional capital to corporate renewable projects.

Performance Tracking and Transparency

Modern enterprises implement sophisticated energy monitoring systems to quantify renewable usage and environmental impact. Standardized reporting frameworks like GRI and SASB enable meaningful comparisons across industries. Investors increasingly treat sustainability disclosures with the same scrutiny as financial statements, making accurate measurement essential for maintaining market confidence.

Motivations Behind the Procurement Shift

Economic Drivers of the Shift

The volatility of fossil fuel markets has become untenable for long-term planning. Corporate treasurers now view renewable power purchase agreements as hedges against energy price fluctuations. Unlike traditional fuels subject to geopolitical shocks, wind and solar contracts offer predictable pricing for decades, enabling accurate financial forecasting.

Innovative financing structures like green bonds and yieldcos have democratized access to renewable projects. These instruments spread upfront costs over asset lifetimes while leveraging favorable tax treatments. The result is improved ROI profiles that appeal to CFOs focused on both sustainability and shareholder returns.

Environmental and Social Responsibility

Modern consumers vote with their wallets, favoring brands demonstrating authentic environmental commitment. Sustainability has become a competitive differentiator, with 66% of global consumers willing to pay premium prices for sustainable goods. This sentiment extends to B2B markets, where procurement departments increasingly evaluate suppliers' renewable energy usage.

Renewable projects create localized economic benefits beyond carbon reduction. Community solar initiatives generate local jobs while providing energy access to underserved populations. These co-benefits strengthen corporate-community relationships and create powerful brand narratives that resonate with stakeholders.

Regulatory and Policy Influences

Carbon border adjustment mechanisms and emissions trading systems are reshaping corporate risk assessments. Non-compliant firms face not just penalties but exclusion from key markets. The European Union's CBAM and similar initiatives worldwide make renewable energy procurement a strategic imperative for maintaining market access.

Regional Variations and Emerging Trends

Regional Differences in Renewable Energy Adoption

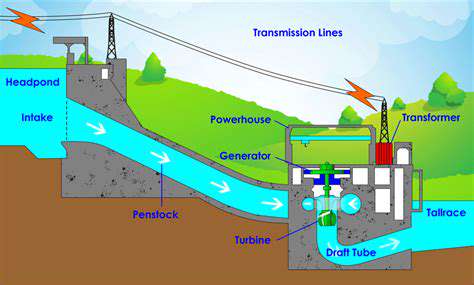

Adoption rates vary significantly by geography, reflecting local resource endowments and policy environments. Solar dominates in sunbelt regions like Australia and the Middle East, while Northern European nations leverage offshore wind potential. Emerging markets face unique challenges, with blended finance solutions helping overcome capital constraints for renewable projects.

Policy Instruments Driving Change

The effectiveness of policy tools varies by jurisdiction. Feed-in tariffs succeeded in jumpstarting early adoption but are being replaced by competitive auctions in mature markets. Corporate renewable energy certificates (RECs) have emerged as flexible compliance instruments, though concerns about additionality persist.

Innovative Procurement Models

Virtual power purchase agreements (VPPAs) now represent 60% of corporate renewable deals, allowing companies to support projects beyond their physical locations. Aggregated procurement consortia enable smaller players to access utility-scale renewable projects previously available only to tech giants and multinationals.

Technology Convergence

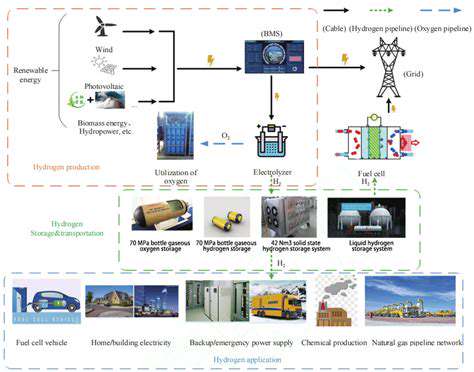

Artificial intelligence optimizes renewable asset performance, while blockchain enables transparent renewable energy certificate tracking. Green hydrogen production promises to decarbonize hard-to-abate industrial processes, creating new opportunities for corporate offtake agreements.

The Future of Corporate Renewable Energy Procurement

The Growing Demand for Sustainable Practices

Sustainability commitments now influence everything from talent acquisition to M&A valuations. ESG metrics directly impact cost of capital, with renewable energy adoption serving as a key differentiator. Forward-thinking companies now treat carbon reduction as a core KPI alongside traditional financial metrics, embedding sustainability into all operational decisions.

Next-Generation Technologies

Perovskite solar cells promise efficiencies exceeding 30%, while floating offshore wind unlocks previously inaccessible resources. Advanced geothermal systems could provide baseload renewable power, complementing intermittent sources. These innovations will further improve the economics of corporate renewable procurement.

Financial Innovation

Sustainability-linked bonds tie interest rates to renewable energy targets, while carbon credit markets create additional revenue streams. These instruments help corporations monetize their sustainability investments while meeting stakeholder expectations.

Implementation Challenges

Grid interconnection queues and permitting bottlenecks require innovative solutions. Corporate energy buyers increasingly collaborate with utilities and regulators to streamline processes while maintaining system reliability. These partnerships will be crucial for scaling renewable adoption to meet net-zero targets.