De risking Renewable Energy Investments: Strategies for Capital Protection

Mitigating Regulatory and Policy Risks

Understanding Regulatory Hurdles

Successfully navigating renewable energy investments demands deep familiarity with regulatory frameworks. Local, state, and national policies create a complex web that directly affects project feasibility and financial returns. These rules govern everything from permitting procedures and environmental protections to grid connections and tax benefits. Overlooking these requirements early on often results in costly delays that can derail entire projects.

Conducting exhaustive due diligence helps uncover regulatory pitfalls. This means thoroughly examining current and pending laws, grasping jurisdiction-specific mandates, and forecasting potential policy shifts. Building relationships with government officials and stakeholders through early engagement reduces uncertainty and fosters valuable alliances.

Assessing Policy Stability and Consistency

Long-term project success hinges on predictable government support for renewable energy. When policies change unpredictably or incentives remain unclear, investors face unnecessary risks that can discourage participation. Stable, well-defined policies provide the certainty needed for multi-year commitments.

Evaluating policy risks requires analyzing the political environment, identifying influential interest groups, and anticipating possible shifts. Recognizing potential future conflicts between policies helps develop effective contingency plans.

Mitigating Environmental and Social Impacts

Modern energy projects must balance technical requirements with ecological and community concerns. Strict environmental compliance and genuine social responsibility have become non-negotiable expectations. Impacts on local residents, wildlife habitats, and natural resources require careful assessment and mitigation strategies. Projects that neglect these aspects often face public backlash, legal obstacles, and reputational harm.

Comprehensive environmental studies, meaningful community outreach, and substantive social programs form the foundation for successful projects. Transparent operations and ongoing stakeholder involvement build essential public trust and support.

Ensuring Financial and Legal Security

Sound financial planning and legal protections form the backbone of successful renewable energy ventures. Detailed financial models must account for realistic costs and revenue streams to demonstrate viability to potential backers. Air-tight contracts with suppliers, contractors, and power purchasers protect all parties' interests while minimizing disputes.

Comprehensive insurance coverage and contingency reserves provide buffers against unexpected challenges. Diversified funding sources and experienced legal counsel further strengthen project resilience. Verifying contract enforceability and understanding potential liabilities during due diligence prevents costly surprises later.

Optimizing Financial Structures and Investment Vehicles

Understanding the Components of a Financial Structure

A well-designed financial framework serves as the foundation for organizational success. This system coordinates various financial tools and approaches for effective resource management, from capital allocation to funding strategies. Mastering how these elements interact enables better decision-making and financial outcomes.

Financial structures must align with an organization's unique characteristics including scale, sector, growth potential, and risk appetite. Thoughtful analysis of these factors leads to optimal financial planning.

Strategies for Debt Management

While debt instruments can fuel expansion, they require disciplined oversight to maintain fiscal health. Effective debt strategies account for interest costs, payment timelines, and overall cash flow impacts. Proactive debt management prevents financial strain while enabling growth opportunities.

Successful organizations implement regular debt reviews and flexible repayment adjustments to maintain stability during changing economic conditions.

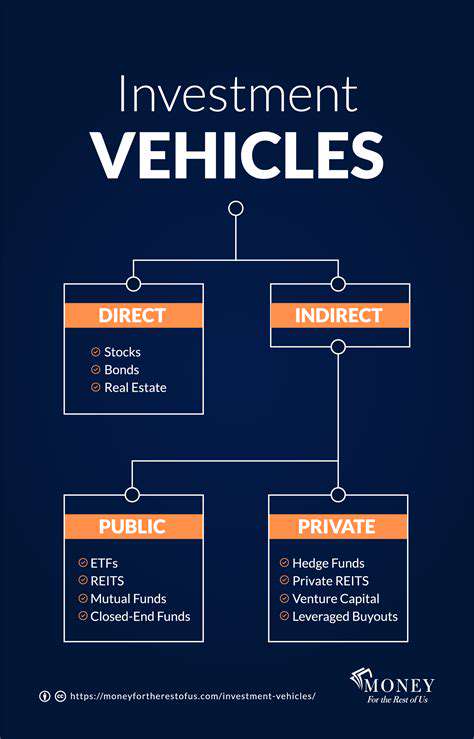

Equity Financing and its Role

Equity investments provide alternative funding sources, particularly valuable for high-growth companies needing substantial capital. These arrangements range from public stock offerings to specialized deals with venture capital or private equity partners, each offering distinct advantages.

Leveraging Technology for Efficiency

Contemporary financial operations increasingly incorporate digital solutions. Fintech innovations streamline accounting, budgeting, and reporting processes while improving accuracy and transparency. Automation handles routine tasks efficiently, allowing financial teams to focus on strategic priorities and value-added activities.

Assessing and Adapting to Market Fluctuations

Financial strategies must remain responsive to evolving market conditions, economic shifts, and regulatory updates. Continuous monitoring of key indicators and timely strategy adjustments maintain competitive advantage. This requires tracking economic trends, industry developments, and adapting financial approaches to sustain organizational health through changing environments.