Renewable Energy Procurement for the Tech Sector

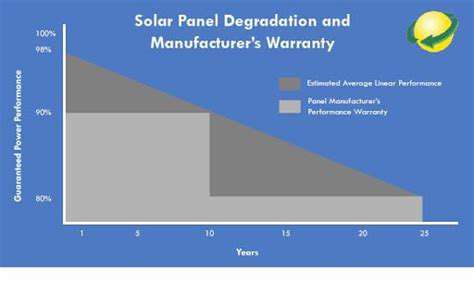

Harnessing sunlight has become increasingly vital in our transition to sustainable energy solutions. Unlike finite fossil fuels, solar power offers an abundant and environmentally friendly alternative that could reshape our energy landscape. Recent breakthroughs in photovoltaic technology have dramatically lowered costs, making solar panels practical for homes and businesses alike.

Government incentives and evolving policies continue to accelerate solar adoption globally. The International Energy Agency reports solar capacity grew by 22% last year alone, demonstrating its growing role in national energy strategies.

Harnessing the Wind: Nature's Reliable Power Source

Modern wind turbines represent a significant leap forward in clean energy production. Strategic placement in high-wind areas allows these engineering marvels to generate substantial electricity with minimal environmental impact. Advanced materials and aerodynamic designs have increased efficiency while reducing maintenance needs.

The latest turbine models can operate at wind speeds as low as 3 m/s while surviving gusts exceeding 25 m/s. This reliability makes wind energy particularly valuable for grid stability and baseload power supplementation.

Water Power: Tapping Into Hydraulic Potential

Hydroelectric systems continue to provide about 16% of global electricity generation. Modern facilities combine power production with essential water management functions. These installations demonstrate how renewable energy can serve multiple community needs simultaneously.

Environmental considerations remain paramount in new hydro projects. Recent designs incorporate fish-friendly turbines and sediment management systems to minimize ecological disruption while maintaining high energy output.

Geothermal Solutions: Earth's Hidden Energy Reserve

The development of enhanced geothermal systems (EGS) has expanded potential applications beyond traditional hotspots. These innovative approaches could make geothermal viable in regions previously considered unsuitable. Pilot projects in Europe and North America show promising results, with some achieving commercial-scale electricity production.

Recent MIT studies suggest EGS could provide up to 10% of U.S. electricity needs by 2050. The technology's ability to deliver baseload power makes it particularly valuable for grid stability.

Bioenergy: Closing the Organic Loop

Advanced bioenergy systems now convert agricultural byproducts into clean fuels with remarkable efficiency. This approach addresses both energy needs and waste management challenges. Second-generation biofuels avoid food crop competition by utilizing non-edible plant materials.

Innovations in enzymatic conversion and gasification technologies have improved yields while reducing processing costs. The U.S. Department of Energy estimates bioenergy could displace 30% of petroleum consumption in transportation by 2030.

Innovative Approaches to Renewable Energy Acquisition

Direct Energy Purchasing Strategies

Forward-thinking corporations increasingly negotiate customized power agreements with renewable producers. These arrangements often include fixed pricing structures that provide budget certainty while supporting clean energy development. The process typically involves thorough due diligence to assess project viability and environmental benefits.

Major tech firms have pioneered this approach, with several achieving 100% renewable operations through tailored procurement strategies. These deals frequently include clauses for technology upgrades as efficiency improves.

The Role of Renewable Energy Certificates

RECs serve as verifiable proof of clean energy generation, allowing organizations to support renewables indirectly. While useful for sustainability reporting, experts recommend pairing REC purchases with direct renewable investments for maximum impact. Third-party verification services have emerged to ensure certificate authenticity and prevent double-counting.

The voluntary REC market grew 28% last year, reflecting increasing corporate sustainability commitments. However, critics argue for stronger standards to ensure actual emissions reductions.

Contractual Frameworks for Clean Power

Modern PPAs have evolved to address various risk factors, including production variability and price fluctuations. Some agreements now incorporate hybrid structures combining fixed and variable components. Virtual PPAs have gained popularity, allowing energy procurement across regional boundaries.

Financial institutions have developed specialized instruments to hedge PPA risks, making these contracts more accessible to mid-sized enterprises. The global PPA market exceeded $50 billion in transactions last year.

Community-Based Energy Solutions

Shared solar initiatives have democratized renewable access, particularly in urban areas. These programs often feature innovative billing mechanisms that credit participants for their share of generation. Some states have implemented legislation to standardize program structures and consumer protections.

A recent DOE study found community solar could serve 50% of U.S. households unable to install rooftop systems. The model has proven particularly effective for renters and low-income communities.

Green Financing Innovations

The green bond market has diversified to include various risk-return profiles, attracting institutional investors. New instruments like sustainability-linked bonds tie financial terms to environmental performance targets. Specialized funds now focus exclusively on renewable infrastructure projects.

BloombergNEF reports green energy investments surpassed $500 billion globally in 2023. This capital influx continues to drive technological advancements and cost reductions across renewable sectors.

Emerging Developments in Renewable Energy

The Distributed Energy Revolution

Local energy networks are transforming traditional utility models through peer-to-peer trading platforms. Advanced metering infrastructure now enables real-time energy exchanges between prosumers. Microgrid technologies combine distributed generation with smart controls for enhanced reliability.

Regulatory frameworks are evolving to accommodate these changes, with several states piloting innovative tariff structures. The Federal Energy Regulatory Commission recently approved new rules to facilitate distributed resource participation in wholesale markets.

Storage Solutions for Renewable Integration

Next-generation batteries are achieving record energy densities while reducing material costs. Flow battery technology shows particular promise for long-duration storage applications. Thermal storage systems using molten salts or phase-change materials offer alternative solutions for industrial applications.

The U.S. storage market grew 80% year-over-year, with projections suggesting 100 GW of new capacity by 2030. Utilities increasingly view storage as essential for renewable integration rather than supplemental infrastructure.

Intelligent Grid Modernization

Digital substations equipped with IoT sensors enable predictive maintenance and fault detection. Advanced distribution management systems optimize power flows in real-time using AI algorithms. Blockchain applications are being tested for renewable energy certificate tracking and microtransactions.

The U.S. Department of Energy's Grid Modernization Initiative has allocated $3.5 billion for smart grid demonstrations. These projects aim to prove the technical and economic viability of next-generation grid technologies.

Policy Evolution for Clean Energy

Carbon pricing mechanisms are gaining traction as tools to accelerate renewable adoption. Renewable portfolio standards continue to strengthen, with several states targeting 100% clean electricity by 2040. International agreements like the Paris Accord create framework for coordinated climate action.

The Inflation Reduction Act's clean energy provisions represent the largest U.S. investment in renewable technologies to date. Analysts predict these policies could reduce emissions 40% below 2005 levels by 2030.

Circular Economy in Energy Infrastructure

Solar panel recycling technologies now recover over 95% of materials for reuse. Wind turbine blade repurposing initiatives turn decommissioned equipment into construction materials. Lifecycle assessment tools help developers minimize environmental impacts from project conception through decommissioning.

The European Union's circular economy action plan includes specific provisions for renewable energy equipment. Manufacturers increasingly design products with end-of-life recovery in mind.

Economic Realities of Energy Transition

Levelized costs for renewables continue to fall, with solar and wind now cheaper than fossil alternatives in most markets. Innovative financing models like yieldcos provide stable returns for infrastructure investors. Risk mitigation instruments help attract private capital to emerging markets.

A recent Lazard study found renewable generation costs have declined 72-90% over the past decade. These economic fundamentals suggest continued strong growth despite macroeconomic uncertainties.