The Economic Transformation Driven by Renewable Energy

The Growing Demand for Sustainable Practices

Today's consumers are far more conscious about the environmental footprint of their purchases than ever before. People want to know where products come from, how they're made, and what impact they have on the planet. This heightened awareness is reshaping entire industries, pushing companies to rethink their operations from the ground up. Businesses that fail to adapt risk losing customers to more eco-conscious competitors.

Forward-thinking organizations are discovering that sustainability isn't just good for the planet - it's good for business too. By embedding green principles into their DNA, companies are building stronger relationships with customers who value transparency and responsibility. This creates a powerful cycle where environmental action drives customer loyalty, which in turn fuels more sustainable innovation.

Investing in Renewable Energy and Efficiency

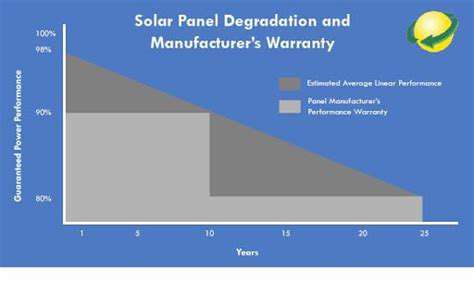

The energy landscape is undergoing a dramatic transformation. Solar panels and wind turbines are becoming common sights as the world moves away from fossil fuels. What was once considered alternative energy is now mainstream, with technological breakthroughs making renewables more efficient and affordable than ever. Beyond just power generation, businesses are finding clever ways to use less energy through smart building designs, efficient equipment, and waste reduction strategies.

These changes make solid financial sense. Companies that invest in energy efficiency often see quick returns through lower utility bills. Meanwhile, the renewable energy sector itself has become a major job creator, offering new opportunities in manufacturing, installation, and maintenance.

Sustainable Supply Chains and Resource Management

Modern businesses are looking at their supply chains with fresh eyes, examining every link for environmental impact. This means choosing suppliers who use responsible methods, minimizing transportation emissions, and finding ways to reuse materials. The most progressive companies are turning waste streams into revenue streams, finding innovative ways to repurpose byproducts that would otherwise end up in landfills.

Innovation in Sustainable Technologies and Products

Breakthroughs in green technology are happening at breakneck speed. From plant-based packaging to carbon capture systems, inventors are developing solutions to our toughest environmental challenges. These innovations aren't just helping the planet - they're creating entirely new industries and job categories. Entrepreneurs who spot these opportunities early stand to benefit as demand for sustainable solutions grows.

The Rise of Circular Economies

The old take-make-waste model is giving way to circular thinking. Companies are designing products to last longer, be easily repaired, and eventually recycled into new products. This shift requires reimagining everything from product design to customer service models. The circular approach isn't just environmentally sound - it often reveals unexpected cost savings and revenue opportunities by finding value in what was previously considered waste.

Government Policies and Incentives for Sustainability

Policy makers worldwide are creating frameworks to accelerate the green transition. Tax credits for renewable energy installations, stricter emissions standards, and grants for clean tech startups are all part of the mix. While regulations create compliance costs, they also create certainty for businesses planning long-term investments. Smart companies stay ahead of these policy changes to position themselves as leaders in the new green economy.

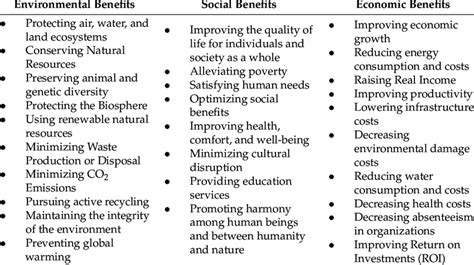

The Social Impact of Sustainability

The sustainability movement goes beyond environmental benefits. Ethical sourcing ensures fair wages and safe conditions for workers globally. Green jobs often pay well and can't be outsourced, strengthening local economies. Companies that embrace sustainability holistically find they're not just reducing harm, but actively making communities stronger and more resilient.

Job Creation and Economic Diversification

Job Creation Strategies

Building a dynamic job market requires nurturing both existing businesses and new ventures. Supporting entrepreneurs with funding and mentorship is particularly impactful, as startups often drive innovation and create clusters of related jobs. Community colleges and vocational programs play a crucial role in preparing workers for emerging fields through targeted training.

The most successful job initiatives combine public and private sector efforts, with businesses identifying skill needs and educators developing responsive programs. This collaboration ensures training remains relevant as industries evolve. Apprenticeship models that combine classroom learning with paid on-the-job training have proven especially effective.

Economic Diversification Initiatives

Regions that rely too heavily on a single industry are vulnerable to market shifts. Diversification acts as an economic shock absorber, creating multiple pathways for growth. This requires intentional investment in promising sectors alongside support for existing industries to modernize and adapt.

Successful diversification often starts with identifying a region's unique advantages - whether that's geographic location, existing expertise, or natural resources. Building on these strengths makes growth more sustainable than chasing every new trend. Tax policies and infrastructure investments can then be tailored to support targeted industries.

Targeted Industry Development

Certain sectors offer outsized potential for quality job creation. Advanced manufacturing combines traditional skills with cutting-edge technology, while biotech taps into growing healthcare needs. Sustainable agriculture merges ancient wisdom with modern science to meet demand for healthier food.

The key is supporting these industries without picking winners. Rather than massive subsidies for specific companies, the focus should be on creating fertile ground for innovation through research funding, streamlined regulations, and workforce development. Small and medium businesses often drive the most organic growth in these sectors.

Infrastructure Development and Workforce Enhancement

Modern infrastructure is the backbone of economic growth. Reliable broadband is as crucial as roads in today's economy, enabling remote work and digital businesses. Smart investments in transportation networks reduce costs for all businesses while improving quality of life.

A workforce that can adapt to change is equally important. Lifelong learning programs help workers transition between industries as needed. Partnerships between employers and educators ensure training keeps pace with technological changes, preventing skills gaps before they emerge.

Investment Opportunities and Financial Growth

Investment Strategies for Growth

Smart investing starts with understanding your goals and comfort with risk. Spreading investments across different asset classes smooths out volatility while maintaining growth potential. The most successful investors think long-term, avoiding emotional reactions to short-term market movements.

Technology has democratized investing, with apps making it easy to start small. However, the basics remain unchanged: spend less than you earn, invest the difference consistently, and keep costs low. Automated tools can help maintain discipline during market ups and downs.

Financial Planning for the Future

Creating a financial roadmap begins with tracking income and expenses to identify saving opportunities. The magic of compounding means even small, regular contributions grow significantly over decades. Prioritizing high-interest debt repayment often provides the best return on investment for those starting out.

Life's major expenses - home purchases, education, retirement - require separate strategies. Tax-advantaged accounts like 401(k)s and IRAs multiply savings through deferred taxation. A good plan balances today's needs with tomorrow's goals.

Understanding Financial Markets

Markets move on fundamentals (economic data), sentiment (investor psychology), and unexpected events. Successful investors focus on what they can control: diversification, costs, and time horizon. Trying to time the market rarely works, but staying invested through cycles does.

Information overload is a real challenge in today's 24/7 financial news cycle. Developing a filter for noise versus meaningful trends is crucial. Many find success by automating investments and reviewing portfolios quarterly rather than daily.

Identifying Potential Investment Vehicles

Traditional options like index funds provide broad market exposure at low cost, while individual stocks offer potential upside (with higher risk). Real estate can provide both income and appreciation, though it requires more active management.

New options like ESG funds align investments with personal values without sacrificing returns. The key is matching vehicles to individual circumstances - a young professional's portfolio should look very different from a retiree's. Professional advice can help navigate these choices.

Infrastructure Development and Regional Impact

Infrastructure Development and Regulatory Compliance

Major projects must balance speed with thorough planning. Early community engagement prevents costly delays from opposition, while environmental reviews, though time-consuming, create better long-term outcomes. The most successful projects integrate regulatory requirements from the earliest design phases.

Public-private partnerships can accelerate projects while sharing risks. Clear performance standards combined with flexibility in achieving them often yield the best results. Technology like BIM (Building Information Modeling) is revolutionizing planning and coordination.

Investment Strategies and Financial Models

Infrastructure financing requires creative solutions. Green bonds attract investors focused on sustainability, while tolling models can fund transportation projects. Accurate lifecycle cost estimates prevent nasty surprises years after completion.

Scenario planning helps projects weather economic shifts. Contingency funds and flexible designs allow adaptation to changing conditions without derailing timelines. Transparent accounting builds trust with all stakeholders.

Project Management and Stakeholder Engagement

Modern project management tools provide real-time visibility into progress and issues. Breaking large projects into smaller phases allows for course corrections. Regular community updates turn potential critics into allies by addressing concerns early.

Workforce development should begin before construction, creating local jobs. Safety programs protect workers while keeping projects on schedule. Post-completion maintenance plans ensure long-term benefits.