Strategic Drivers for Corporate Renewable Procurement

Understanding ESG Integration

Environmental, Social, and Governance (ESG) factors are now seen as indispensable elements in shaping long-term corporate strategies. ESG integration goes beyond mere compliance—it's about embedding these principles into the very fabric of decision-making processes. Organizations must weigh environmental impact, social responsibility, and governance standards alongside traditional financial metrics when evaluating investments, managing risks, and setting objectives.

Forward-thinking companies that embrace ESG considerations tend to grasp their broader societal influence more acutely. This positions them advantageously to adapt to shifting regulatory frameworks and evolving stakeholder demands.

The Growing Importance of Environmental Factors

Climate change, resource scarcity, and pollution have catapulted environmental concerns to the forefront of corporate agendas. Businesses are awakening to the necessity of minimizing their ecological footprint while transitioning to sustainable operations. This shift involves cutting carbon emissions, optimizing resource utilization, and adopting eco-friendly technologies.

Transparency in environmental performance has become non-negotiable, with both investors and consumers demanding accountability. Companies that demonstrate genuine environmental stewardship often enjoy enhanced capital inflows and stronger customer allegiance.

Social Responsibility and Stakeholder Engagement

The social dimension of ESG spans labor practices, human rights, diversity initiatives, community relations, and product safety. Modern corporations are expected to uphold ethical employment standards, ensure fair treatment of workers, and contribute positively to local communities.

Nurturing robust relationships with all stakeholders—employees, customers, suppliers, and community members—has become fundamental for enduring success. Effective engagement strategies build trust and fortify corporate reputations in our interconnected global economy.

Governance and Corporate Accountability

Sound governance practices form the backbone of transparent, accountable, and ethical corporate operations. This encompasses clear policy frameworks, diverse leadership teams, strong ethical cultures, and strict regulatory compliance.

Well-structured governance systems not only mitigate risks but also cultivate stakeholder confidence and foster sustainable value creation over the long haul.

ESG Integration and Financial Performance

Mounting evidence indicates that robust ESG performance correlates with superior financial outcomes. Companies excelling in ESG integration typically showcase enhanced operational efficiency, reduced risk exposure, and stronger brand equity. These advantages frequently translate into greater investor trust, lower financing costs, and improved long-term valuation.

The Role of Investors in Driving ESG Integration

The investment community has emerged as a powerful force propelling ESG adoption. Asset managers are increasingly incorporating ESG metrics into their evaluation processes while demanding greater transparency from portfolio companies. This paradigm shift includes comprehensive ESG due diligence, ongoing sustainability assessments, and preferential treatment for firms with mature ESG programs.

Regulatory Landscape and Stakeholder Expectations

Both government mandates and stakeholder pressures are intensifying the focus on ESG compliance. Corporations face mounting expectations to demonstrate tangible commitments to environmental stewardship, social equity, and ethical governance. Navigating this evolving landscape successfully is paramount for preserving corporate reputation and ensuring business continuity.

Cost Optimization and Long-Term Value Creation

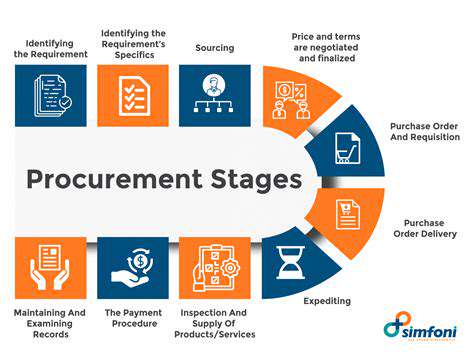

Strategic Procurement for Cost Savings

Implementing robust strategic procurement processes unlocks significant cost-saving potential. This requires thorough supplier vetting, astute contract negotiations, and technological integration to streamline procurement cycles. Competitive bidding processes coupled with rigorous evaluation frameworks can yield substantial material cost reductions while boosting operational efficiency.

Strategic procurement transcends simple cost-cutting—it's a catalyst for innovation and quality enhancement. Collaborative supplier relationships provide insights into emerging technologies and market trends, paving the way for sustainable supply chains and future growth opportunities.

Process Optimization for Efficiency Gains

Systematic process improvement drives both cost reduction and efficiency improvements. Identifying workflow bottlenecks, implementing automation solutions, and adopting project management best practices can generate significant savings. Detailed process analysis frequently reveals unexpected optimization opportunities.

Beyond financial benefits, streamlined processes enhance work quality and minimize errors. Standardized procedures combined with comprehensive training programs ensure operational consistency, leading to improved customer satisfaction and brand reputation.

Technology Integration for Enhanced Productivity

Strategic technology adoption is indispensable for modern cost optimization efforts. Advanced software solutions automate routine tasks, improve data analytics capabilities, and enhance communication efficiency. Digital transformation initiatives can dramatically boost productivity while reducing long-term operational expenses.

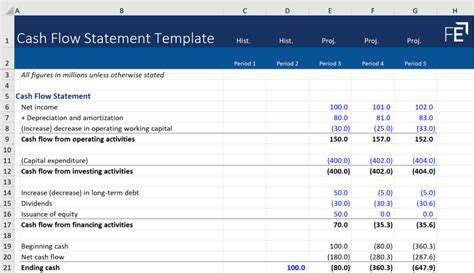

From enterprise systems to cloud-based platforms, technology integration offers multiple avenues for efficiency gains. Data analytics provides invaluable market and operational insights, enabling informed decision-making and optimal resource allocation.

Resource Allocation and Prioritization

Strategic resource deployment is critical for maximizing investment returns. Aligning resources with high-impact initiatives that support business strategy ensures optimal value creation. This necessitates careful project evaluation based on strategic alignment and projected ROI.

Talent Management and Skills Development

Workforce investment represents a cornerstone of sustainable value creation. Continuous learning and skills development programs ensure employees possess the capabilities to drive innovation and achieve strategic objectives. A skilled, engaged workforce is essential for navigating business complexities and sustaining growth. Effective talent strategies attract top performers while fostering cultures of continuous improvement.

Outsourcing and Strategic Partnerships

Outsourcing non-core functions can dramatically reduce operational costs while freeing internal resources for strategic priorities. External partnerships provide access to specialized expertise that may not exist internally. Carefully selected partners who share corporate values and strategic vision can accelerate innovation, expand market reach, and create competitive differentiation.