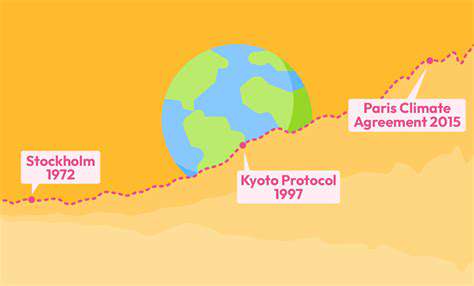

International Climate Agreements and Their Impact on Renewable Energy Investment

Analyzing the Impact on Investment Flows

Understanding the Market Dynamics

Market dynamics analysis plays a pivotal role in uncovering lucrative investment avenues. The intricate relationship between supply-demand cycles, monetary policies, and macroeconomic signals requires careful examination. By studying both immediate patterns and extended trajectories, analysts can forecast market movements and their probable effects on capital allocation. Comprehensive market scrutiny forms the bedrock of prudent financial choices and risk mitigation.

Today's investment landscape reflects the convergence of geopolitical developments, digital transformation, and shifting buyer behaviors, all of which directly affect portfolio performance. Astute investors recognize how these evolving elements differentially impact various industries, enabling them to refine their asset distribution tactics accordingly.

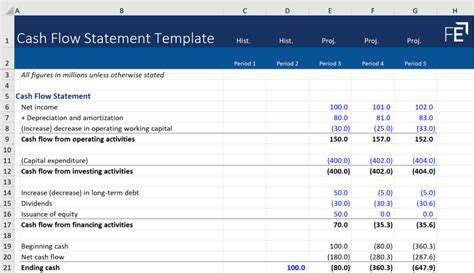

Assessing the Financial Performance

Financial health evaluation stands as a cornerstone for judging investment potential. Meticulous review of accounting documents – encompassing profit-loss statements, financial positions, and capital movement reports – proves indispensable. Key metrics like earnings ratios, working capital indicators, and leverage measurements offer critical perspectives on an enterprise's fiscal stability.

Historical financial results combined with forward-looking growth estimates constitute vital assessment components. Parameters including sales expansion, expenditure control, and margin trajectories require careful consideration. Consistent past achievements paired with credible future forecasts often signal promising investment prospects.

Evaluating the Risk Factors

Risk assessment represents a fundamental aspect of investment analysis. All financial commitments inherently involve uncertainty. Critical examination must address market instability, recession possibilities, sector-specific vulnerabilities, and competitive threats. Proper evaluation of these elements enables investors to optimize returns while limiting downside exposure.

Thorough comprehension of an investment's unique hazards proves essential prior to capital deployment. Portfolio diversification serves as an effective risk management tool. Allocating resources across varied asset categories and industries reduces concentration risk and enhances overall stability.

Considering the External Factors

Macro-environmental influences – including international relations, legislative modifications, and technological breakthroughs – can dramatically alter investment outcomes. Holistic analysis must incorporate these variables as they shape economic currents, corporate results, and ultimately investment performance. Accounting for these external pressures is imperative when formulating resilient investment approaches.

Price inflation analysis, monetary policy impacts, and foreign exchange variations demand particular attention. These macroeconomic forces frequently determine asset valuations and can substantially influence long-term returns, adding sophistication to the analytical process.

Challenges and Future Directions

Negotiating Global Consensus

Climate diplomacy among nations with disparate economic conditions and governance systems presents ongoing difficulties. Effective environmental accords must reconcile aspirational targets with practical considerations, particularly regarding developing nations' special circumstances. Establishing mutual understanding around emission controls, resilience building, and climate financing remains vital for meaningful international coordination.

The legacy emissions of industrialized economies, coupled with increasing discharges from emerging markets, creates complex negotiation dynamics. Balancing historical accountability with contemporary development needs requires thoughtful policy design.

Addressing Financial Gaps

Climate financing shortfalls in developing regions continue posing implementation barriers. Many emerging economies face resource constraints that limit their ability to execute necessary environmental projects, slowing progress toward sustainability goals. Reliable funding mechanisms that efficiently support impactful climate initiatives are urgently needed.

Ensuring Transparency and Accountability

Implementing verifiable reporting systems for climate commitments is fundamental for establishing credibility and achieving concrete results. Standardized disclosure frameworks coupled with rigorous performance tracking help measure advancement and highlight improvement areas.

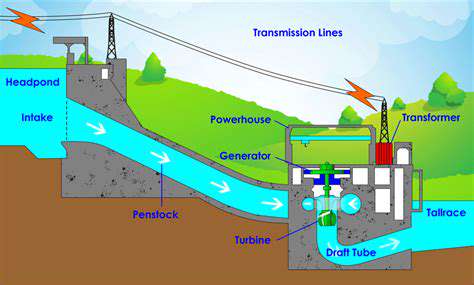

Technological Innovation and Transfer

Accelerating clean technology development and dissemination to emerging markets is crucial for global decarbonization. Cultivating innovation ecosystems and facilitating cross-border knowledge exchange ensures broader accessibility to sustainable solutions.

This necessitates strengthening partnerships between academic institutions, corporations, and policymakers worldwide. Addressing technology ownership issues while ensuring fair distribution channels represents another critical implementation factor.

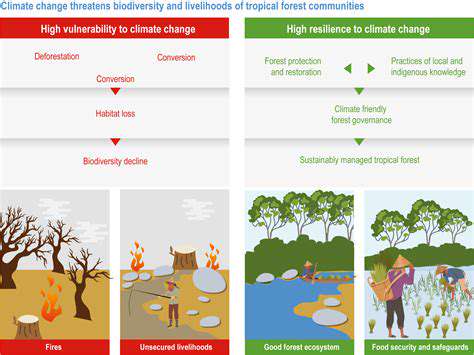

Adapting to Unpredictable Impacts

Climate disruption already manifests through intensified weather extremes, coastal inundation, and ecological disturbances. Developing adaptive capacity to manage these challenges and enhance system resilience is paramount for protecting communities and infrastructure. International knowledge sharing regarding adaptation techniques is essential for effective climate preparedness.

Encouraging Public Engagement and Awareness

Climate literacy initiatives and participatory programs help generate societal momentum for environmental action. Disseminating scientific understanding about climate mechanisms, consequences, and response options fosters sustainable cultural transformation. Global cooperation in awareness campaigns strengthens collective commitment to change.

Promoting Sustainable Consumption and Production

Transitioning to eco-conscious economic models is vital for emission reduction and circular system development. International coordination on sustainability standards across industrial, agricultural, and logistical sectors is necessary. Supporting green technology advancement and implementing sustainable practices throughout value chains represent key transition pathways.