Distributed Energy Resources (DERs): Investment Opportunities in Local Grids

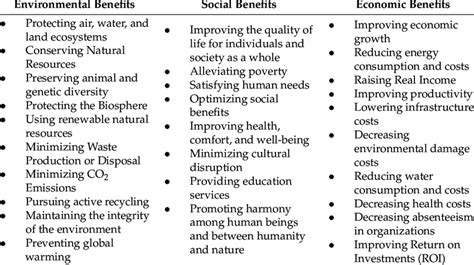

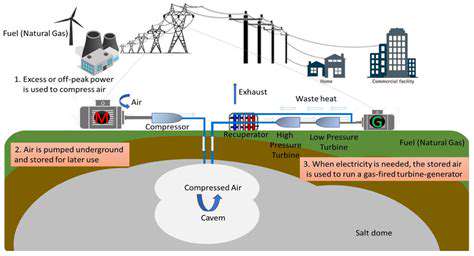

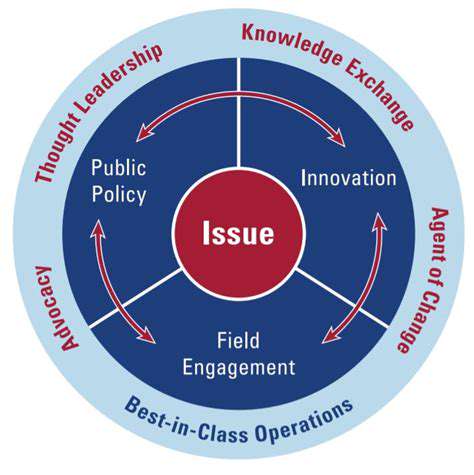

The increasing adoption of distributed energy resources (DERs) is transforming how we think about power generation. Unlike traditional centralized systems, DERs—such as rooftop solar panels, battery storage, and microgrids—empower consumers to produce their own electricity. This shift isn't just about technology; it's a fundamental reimagining of energy independence and community resilience. By reducing reliance on distant power plants, DERs cut transmission losses and strengthen grid stability during outages.

Several forces drive this change: renewable tech costs have plummeted, policies now reward clean energy adoption, and public awareness of sustainability has never been higher. What makes DERs truly revolutionary is their dual role—they're not just energy solutions but economic catalysts, sparking innovation across the energy sector.

The Impact of DERs on the Energy Grid

DERs are turning the century-old grid model on its head. Where power once flowed one way (from plant to outlet), these systems enable households to send excess electricity back to the grid. This two-way flow demands smarter infrastructure—think advanced sensors and AI-driven management systems that balance supply from thousands of decentralized sources. The grid isn't just getting an upgrade; it's undergoing a complete nervous system overhaul.

These changes unlock powerful efficiencies. When DERs participate in demand response programs, they can collectively lower peak demand—like a neighborhood battery network reducing strain during heatwaves. Utilities benefit from deferred infrastructure costs, while consumers enjoy lower bills. Success hinges on one critical factor: real-time visibility. New monitoring systems must track every solar panel and battery like air traffic control monitors planes.

This transformation also reshapes business relationships. Traditional utility-customer dynamics give way to partnerships where homes and businesses become prosumers—both producing and consuming energy. The future grid resembles an energy democracy more than a monopoly.

Financial Incentives and Policy Support

Financial Incentives for Sustainable Practices

Smart financial mechanisms are accelerating the green transition. Consider how investment tax credits for solar installations created America's rooftop revolution—every dollar deducted from taxes made panels more accessible. These incentives work best when they bridge the gap between future savings and upfront costs. Similarly, utility rebates for insulation or heat pumps often cover 30-50% of expenses, making upgrades irresistible.

Policy Support for Sustainable Development

Effective policies create certainty for long-term investments. California's solar mandate for new homes didn't just increase installations—it forced the construction industry to master solar integration. Regulations become transformative when they shift entire industries, not just individual choices. London's congestion charge zone demonstrates how disincentives (like fees for gas vehicles) can be as powerful as subsidies.

Impact on Investment Decisions

Money follows certainty. When Germany introduced feed-in tariffs guaranteeing solar producers premium rates for 20 years, it created a gold rush. The lesson? Predictable returns unlock capital. Today's ESG investors scrutinize sustainability incentives—a wind farm with production tax credits often beats fossil fuels on pure economics.

Incentivizing Consumption Shifts

Behavioral economics meets energy policy in programs like electric vehicle tax credits. Norway's approach—exempting EVs from VAT and tolls—made Teslas cheaper than gas cars. When green choices become the rational economic choice, adoption follows.

Analyzing Market Trends and Future Projections

Understanding Market Dynamics

Market intelligence separates leaders from followers. When Tesla recognized that battery costs were falling faster than analysts predicted, they accelerated Gigafactory plans. The best forecasts combine hard data with technological intuition. Solar panel price drops—80% in a decade—weren't linear but followed learning curve models.

Competitive Landscape Shifts

The energy storage market illustrates disruption. Traditional utilities now compete with automotive companies repurposing EV batteries for grid storage. Watch for unexpected players—like oil majors becoming offshore wind leaders.

Challenges and Considerations for Investors

Financial Viability and Risk Assessment

DER investments require scenario planning. A solar farm's returns depend on sunshine, electricity prices, and policy stability—variables with different risk profiles. Smart investors model multiple futures, from optimistic tech breakthroughs to regulatory rollbacks. Battery projects face particular complexity—their value comes from both energy shifting and grid services.

Integration Complexities

Connecting DERs isn't plug-and-play. A neighborhood microgrid might require transformer upgrades—costs often overlooked in initial proposals. The most successful projects budget 15-20% for unforeseen integration expenses.

Technology Lifespan

Solar panels last 25+ years, but inverters need replacement every 10-15 years. Operations and maintenance costs can make or break long-term returns. Forward-looking contracts that include performance guarantees help mitigate these risks.