Risk Hedging: Strategies for Locking in Long Term Energy Costs

Hedging in Agriculture

Farm operators commonly adopt hedging practices to stabilize income streams against volatile crop valuations. These price swings can make or break agricultural operations, making risk mitigation crucial. For instance, a soybean farmer might secure futures contracts to guarantee a fixed selling price for their yield, insulating themselves from market turbulence. This approach delivers pricing certainty and financial security when harvest prices might otherwise collapse.

Hedging and Market Volatility

Erratic market movements keep investors and corporate treasurers awake at night. Hedging constructs financial shock absorbers to soften the blow of these unpredictable gyrations. While forecasting volatility remains notoriously unreliable, hedging provides measurable control over exposure to these capricious forces. The objective is maintaining equilibrium even when financial markets experience violent convulsions.

The Role of Hedging in Portfolio Management

Modern investment strategies assign hedging a central position in asset allocation. By deploying appropriate protective techniques, money managers can fine-tune portfolios to match risk appetites with return objectives. This balanced methodology limits downside potential while preserving upside opportunities. Effective hedging requires thoughtful implementation aligned with individual tolerance thresholds and financial targets.

The Cost and Complexity of Hedging

Hedging mechanisms, despite their benefits, introduce operational challenges and expense considerations. These strategies typically involve sophisticated financial instruments that demand specialized knowledge. Transaction costs accumulate with each hedge position, and success hinges on accurate market foresight. Thorough comprehension of these trade-offs proves essential before executing any hedging program.

Forward Contracts and Futures Contracts: Locking in Prices

Forward Contracts

Forward contracts represent bespoke arrangements between counterparties to transact assets at predetermined future prices. Unlike their exchange-traded counterparts, these agreements offer customizable terms regarding quantities, delivery schedules, and specifications. This tailored approach enables precise risk management but requires careful negotiation and enforcement mechanisms. Participants assume full price risk between contract initiation and settlement, with positions typically not marked to market. This characteristic makes forwards particularly suitable for parties confident in their market outlook.

The primary advantage lies in price certainty - businesses can secure today's favorable terms for future needs. Agricultural cooperatives and industrial commodity consumers frequently utilize this feature for budgeting certainty. The flexible structure also permits creative financial engineering beyond standardized futures products.

Counterparty risk represents the Achilles' heel of forward contracts. The possibility of default requires thorough credit analysis, collateral arrangements, and sometimes third-party guarantees. Prudent risk managers build safeguards against potential non-performance to protect their positions.

Futures Contracts

Exchange-traded futures standardize contract terms for widespread market participation. These regulated instruments provide transparency, liquidity, and centralized clearing that minimize default risk. The homogeneous nature creates efficient markets where positions can be easily established or unwound.

Daily mark-to-market accounting distinguishes futures from forwards, with gains and losses settled each trading session. This mechanism prevents risk accumulation and provides continuous price discovery. Energy producers, financial institutions, and speculators all participate in these liquid markets to manage their exposures.

The high liquidity of futures markets enables cost-effective position adjustments. Standardized contract specifications facilitate price transparency and efficient execution. These features prove invaluable in volatile commodity markets where timing is critical.

However, the rigid structure of futures may not suit all hedging needs. Some market participants require more tailored solutions than exchange specifications allow. Additionally, the daily settlement process creates cash flow considerations that must be managed.

Options Contracts: A Flexible Approach to Hedging

Understanding Options Contracts

Options confer strategic advantages in risk management through their asymmetric payoff structures. These derivative instruments grant purchasers rights without obligations to transact underlying assets at preset strike prices before expiration dates. This unique characteristic enables sophisticated hedging strategies unavailable through linear instruments.

Options derive their value from underlying asset prices, but their pricing incorporates additional dimensions. Time decay, implied volatility, and moneyness all contribute to premium calculations, creating a multidimensional valuation framework requiring specialized knowledge.

Types of Options Contracts

The options universe divides into call and put varieties, each serving distinct market perspectives. Calls provide upside participation while puts offer downside protection. Mastering this fundamental dichotomy represents the first step in constructing effective options strategies. These instruments enable traders to position for directional moves, volatility changes, or time decay scenarios.

Pricing Options Contracts

Option premiums reflect complex interactions between intrinsic value, time value, and volatility expectations. Implied volatility particularly influences pricing, as uncertainty premium expands during turbulent markets. Sophisticated models like Black-Scholes help quantify these relationships, but market psychology often dominates short-term pricing.

Comprehensive analysis of pricing factors separates successful options traders from speculative gamblers. Recognizing when theoretical values diverge from market prices creates profitable opportunities.

Hedging with Options Contracts

Protective puts exemplify options' risk management utility, creating synthetic insurance policies for long positions. This strategy defines maximum loss potential while preserving unlimited upside. Institutional investors frequently combine options with underlying positions to engineer desired risk/reward profiles.

Such strategic combinations can transform risky assets into conservative holdings, or conservative positions into higher-return vehicles. The flexibility enables precise calibration of portfolio characteristics.

Leverage and Options Contracts

Options magnify market exposure through embedded leverage, where small premium payments control large notional amounts. This characteristic cuts both ways - potentially amplifying gains while exacerbating losses. Risk managers must carefully size positions to avoid overexposure.

The leverage paradox means options can simultaneously reduce portfolio risk while increasing position risk. This duality requires disciplined position management and strict risk controls.

Expiration and Options Contracts

The time-sensitive nature of options introduces unique management challenges. Unlike stocks or futures, options have finite lifespans after which they expire worthless. Traders must monitor time decay and adjust strategies accordingly as expiration approaches.

Calendar management becomes as important as price forecasting in options trading. Successful practitioners develop systematic approaches to rolling positions and managing expiring contracts.

Options Strategies

Advanced traders combine multiple options into strategic combinations. Vertical spreads, iron condors, and butterfly spreads allow precise targeting of volatility expectations and price ranges. These multi-legged positions can profit from time decay, volatility contraction, or range-bound trading.

Strategy selection depends on market outlook, risk tolerance, and capital constraints. The modular nature of options enables endless customization for specific market views.

Physical Energy Trading and Supply Agreements: Direct Control

Physical Energy Trading Fundamentals

Tangible energy commodities like crude oil, natural gas, and wholesale electricity form the backbone of physical trading markets. Unlike paper derivatives, these transactions involve actual product movement through complex supply chains. Successful traders develop expertise in product specifications, transportation logistics, and regional pricing dynamics. Physical market participants must understand refinery yields, pipeline capacities, and storage economics.

The arbitrage process requires identifying geographic or temporal price discrepancies that cover transaction costs. Seasonal demand patterns, weather disruptions, and geopolitical events all create trading opportunities for savvy market participants. Physical trading demands hands-on knowledge that screen-based derivatives traders often lack.

Supply Chain Considerations

The physical energy ecosystem involves interconnected networks of producers, midstream operators, and distribution channels. Each segment presents unique operational challenges, from wellhead production quotas to pipeline nomination procedures. Traders must navigate these complexities while maintaining compliance with safety and environmental regulations.

Building reliable supply relationships proves essential for consistent trading operations. Market intelligence flows through these networks, providing early warnings about potential disruptions or emerging opportunities. Physical traders develop sixth senses for impending logistical challenges.

Market Analysis and Forecasting

Physical traders employ both quantitative models and qualitative assessments in their analysis. Weather pattern recognition, inventory trend analysis, and geopolitical risk evaluation all inform trading decisions. Superior traders synthesize disparate data points into coherent market narratives before competitors.

The most successful analysts combine econometric modeling with boots-on-the-ground intelligence. They recognize when historical patterns break down and adapt their methodologies accordingly. Physical markets reward those who understand both numbers and human behavior.

Risk Management in Physical Energy Trading

Physical positions introduce operational risks beyond financial exposures. Pipeline ruptures, production outages, and force majeure events can derail carefully constructed trades. Prudent traders layer multiple risk controls, including physical hedges, financial derivatives, and insurance products.

Contingency planning separates professional trading operations from speculative ventures. Backup supply arrangements, alternative transportation routes, and emergency storage capacity all form part of comprehensive risk mitigation.

Regulatory Compliance and Legal Aspects

Energy markets operate within complex webs of local, national, and international regulations. Compliance teams monitor evolving rules covering everything from emissions standards to cross-border trade restrictions. Legal counsel reviews contracts to ensure enforceability across jurisdictions.

Logistics and Infrastructure Considerations

The physicality of energy trading demands meticulous logistics planning. Tanker scheduling, pipeline capacity auctions, and storage tank allocations all require precise coordination. Traders who master these operational details gain competitive advantages in tight markets. Delivery timing often means the difference between profit and loss in physical trading.

Beyond Hedging: Energy Efficiency and Conservation Measures

Beyond Hedging: The Importance of Energy Efficiency

While financial hedges address price risk, energy efficiency tackles consumption risk at its source. Systematic reductions in energy intensity provide durable cost savings regardless of market conditions. Forward-thinking organizations integrate efficiency initiatives with traditional hedging programs for comprehensive risk management. This dual approach builds resilience against both price spikes and supply constraints.

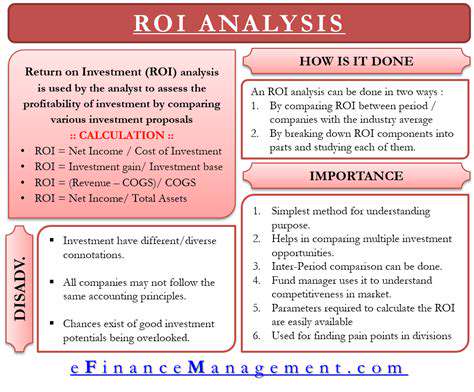

Corporate energy managers increasingly view efficiency investments as financial instruments with predictable returns. Like any capital project, these initiatives require careful analysis of payback periods and return on investment metrics. The most sophisticated programs treat kilowatt-hours saved as a virtual energy supply source.

Improving Building Efficiency

Commercial and industrial facilities represent low-hanging fruit for energy savings. Retrofitting lighting systems, upgrading insulation, and installing smart building controls deliver measurable reductions in energy bills. These improvements frequently qualify for utility rebates and tax incentives that accelerate payback periods. Beyond direct savings, efficiency upgrades often improve occupant comfort and productivity.

Renewable Energy Integration

On-site generation through solar arrays or combined heat and power systems reduces dependence on volatile grid power. These distributed energy resources provide price certainty while offering potential revenue streams through net metering or renewable energy credits. The declining cost curves for solar PV and battery storage make these solutions increasingly attractive.

Sustainable Transportation Strategies

Corporate fleets present significant opportunities for fuel cost reduction. Transitioning to electric vehicles, optimizing delivery routes, and implementing driver training programs all contribute to lower energy consumption. These initiatives frequently align with corporate sustainability goals while delivering hard financial benefits.

Process Optimization for Energy Conservation

Manufacturing operations contain numerous energy waste points that systematic analysis can identify. Compressed air leaks, inefficient motors, and suboptimal production schedules all represent opportunities for improvement. Lean manufacturing principles often yield energy savings alongside productivity gains.

Demand-Side Management Techniques

Strategic load shifting can significantly reduce energy costs in time-of-use rate structures. Industrial consumers can schedule energy-intensive processes for off-peak periods when electricity prices are lowest. Some facilities participate in demand response programs that provide payments for voluntary load reductions during grid stress events.

Employee Training and Awareness Programs

Workforce engagement transforms energy conservation from an engineering function to an organizational culture. Simple behavioral changes - turning off unused equipment, reporting energy waste, and suggesting improvements - collectively make measurable impacts. Effective programs combine education with incentives to sustain participation over time.