Corporate Renewable Procurement: A Guide for Public Companies: Disclosure

Enhancing Financial and Corporate Reporting Through Transparency and Engagement

Transparency and Reporting Standards

Transparency in Financial Reporting

Financial reporting transparency serves as the backbone of investor confidence and market integrity. Market participants depend on precise, comprehensive financial data to guide their investment choices. Companies that prioritize transparent disclosures cultivate trust and enable deeper analysis of their business activities. This practice often results in more efficient capital distribution across markets.

Effective reporting requires detailed presentation of financial metrics - including revenue streams, operational costs, and profit margins - to accurately convey organizational health. Equally important are thorough explanations of accounting methodologies, which help stakeholders comprehend the reasoning behind reported numbers.

Global Reporting Standards

The implementation of International Financial Reporting Standards (IFRS) represents a major advancement in financial transparency. These guidelines create universal parameters for financial documentation across international borders, simplifying comparative analysis between global markets. Such standardization enhances financial statement comparability, delivering substantial benefits to the worldwide investment community.

Internal Controls and Procedures

Strong internal governance mechanisms are fundamental to maintaining reporting accuracy. These systems safeguard against inaccuracies, fraudulent activities, and misrepresentations, thereby supporting transparency objectives. Organizations must continually assess and refine these controls through persistent oversight and regular evaluations.

External Audits and Verification

Third-party audit processes provide indispensable validation of financial statements. Independent auditors offer unbiased evaluations of financial data, significantly boosting the credibility of reported information. This verification mechanism remains vital for establishing stakeholder trust and confidence in corporate disclosures.

Materiality and Disclosure Requirements

The concept of materiality plays a critical role in financial reporting, referring to the relative importance of specific items within an organization's overall financial context. Comprehensive disclosure of all material information - whether favorable or unfavorable - represents a cornerstone of transparent reporting. Omission of material facts can distort perceptions and potentially damage investor relations.

Stakeholder Engagement and Communication

Maintaining open dialogue with investors, analysts, and regulatory bodies is essential for sustaining transparency. Consistent, clear communication channels allow stakeholders to seek clarification and develop accurate understandings of corporate performance. This interaction also facilitates valuable feedback that can improve reporting methodologies.

Ethical Considerations in Reporting

Ethical principles form the foundation of responsible financial reporting. Adherence to high ethical standards guarantees fair and accurate presentation of financial data. This ethical commitment strengthens market confidence and reinforces the overall integrity of financial systems. Corporations must strictly follow professional accounting guidelines and regulatory requirements to uphold these standards.

Stakeholder Engagement and Impact Assessment

Identifying Key Stakeholders

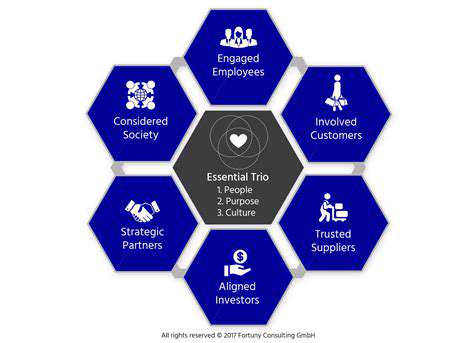

Effective stakeholder engagement represents a critical component of successful corporate renewable energy initiatives. Comprehensive identification of relevant parties - spanning internal departments (procurement, sustainability, finance) and external partners (suppliers, NGOs, community organizations) - forms the foundation of strategic planning. Thorough analysis of stakeholder perspectives, concerns, and potential influences enables development of robust implementation strategies through proactive consultation.

Visual stakeholder mapping provides valuable insights into relationship dynamics and influence patterns, informing communication approaches and collaboration frameworks. This analytical exercise facilitates nuanced understanding of each stakeholder's potential contributions and helps predict implementation challenges.

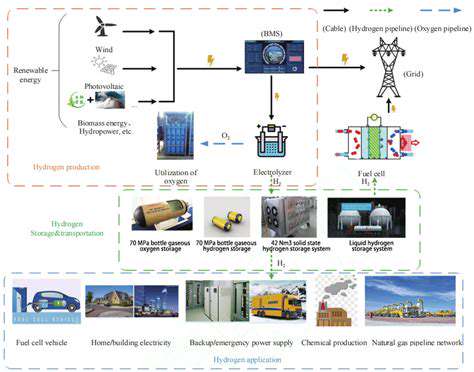

Assessing Potential Impacts

Comprehensive impact analysis is essential for evaluating the full implications of renewable energy adoption. This examination should address environmental consequences, social effects, and economic ramifications. Critical evaluation involves comparing current environmental footprints with projected reductions from renewable alternatives, while also considering employment impacts within the energy sector and analyzing the financial implications of transition costs versus long-term returns.

Developing Engagement Strategies

Customized engagement approaches tailored to specific stakeholder groups significantly enhance program support. Strategy development should account for distinct communication preferences and information needs among different constituencies. Implementation of transparent reporting systems featuring regular progress updates helps maintain stakeholder involvement throughout project lifecycles, while structured feedback mechanisms enable responsive program adjustments.

Measuring and Monitoring Engagement

Quantifiable engagement metrics are vital for demonstrating program effectiveness. Systematic tracking of participation rates in consultations, surveys, and feedback sessions provides measurable indicators of engagement success. Continuous evaluation allows for strategic refinements, while consistent reporting to stakeholders maintains accountability and transparency throughout implementation.

Addressing Potential Conflicts

Proactive identification and management of stakeholder conflicts ensures smoother program execution. Anticipating disagreements regarding timelines, budgetary considerations, or environmental consequences enables preemptive resolution strategies. Constructive conflict resolution through open communication and collaborative problem-solving helps preserve positive stakeholder relationships and prevents potential obstacles.

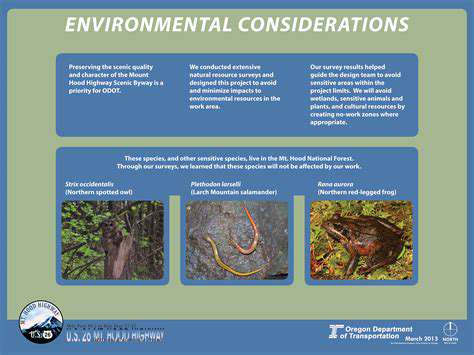

Ensuring Transparency and Accountability

Transparent operations and clear accountability mechanisms are fundamental to stakeholder trust-building. Open sharing of program objectives, progress updates, and challenges through accessible communication channels fosters confidence. Regular reporting and public acknowledgment of both achievements and setbacks demonstrate commitment to continuous improvement and organizational learning.

Communicating Program Outcomes

Effective results communication showcases program value to all stakeholders. Presentation of environmental benefits, cost efficiencies, and social improvements through clear reporting formats - including data visualizations and success narratives - enhances comprehension and reinforces engagement. Testimonials from satisfied participants provide compelling evidence of program impact and encourage ongoing support.

Best Practices for Effective Disclosure

Transparency and Clarity

Organizational trust-building fundamentally depends on transparent disclosure practices. Utilizing straightforward language free from unnecessary technical jargon ensures broad stakeholder comprehension of presented information. Providing contextual explanations for complex data points and detailed methodological descriptions significantly enhances understanding.

Proactive disclosure of potential risks and inherent limitations demonstrates commitment to accuracy and fosters constructive dialogue. Acknowledging areas requiring additional research or analysis prevents misinterpretations while promoting more informed assessment of disclosed information.

Accuracy and Completeness

Thorough verification of all disclosed data ensures reliability and maintains organizational credibility. Comprehensive review processes incorporating internal audits and external validation identify and correct potential inaccuracies. Alignment with relevant regulatory requirements and industry standards must be confirmed during disclosure preparation.

Inclusion of all material information prevents distorted interpretations and ensures balanced understanding. Systematic review of relevant documentation guarantees comprehensive coverage of all significant details within disclosures.

Conciseness and Structure

Well-organized disclosures with logical information flow maximize effectiveness. Strategic use of formatting elements - including section headings, bullet points, and visual aids - enhances readability and facilitates information absorption. Data visualization tools like charts and graphs effectively communicate complex trends while maintaining audience engagement.

Timeliness and Accessibility

Prompt information release demonstrates organizational responsiveness and commitment to transparency. Timely disclosures enable informed stakeholder decision-making and help mitigate potential risks associated with information delays.

Accessibility considerations ensure information reaches all stakeholders effectively. Offering multiple format options and employing clear language conventions accommodates diverse audience needs and promotes broader understanding.