The Role of Policy in Shaping Renewable Energy Market Structures

Financial Mechanisms for Investment Attraction

Building investor confidence demands a solid financial structure that clearly communicates potential returns while minimizing risks. A predictable regulatory environment forms the backbone of such systems, complemented by access to capital markets and customized incentives. When governments maintain transparency in policies and procedures, it creates a virtuous cycle of trust and positive perception about investment opportunities.

Innovative financial tools like venture capital funds and government-backed loans can dramatically enhance funding for promising sectors. Risk-sharing arrangements prove particularly valuable when dealing with inherently uncertain projects. Public-private partnerships (PPPs) demonstrate this principle well, where governments strategically absorb portions of risk to catalyze private sector involvement.

Feed-in Tariffs: A Key Incentive Tool

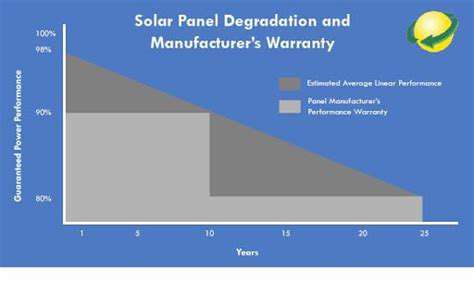

Renewable energy projects gain substantial momentum through feed-in tariffs (FITs), which guarantee electricity pricing above market rates. This pricing security transforms marginal projects into viable investments, accelerating the adoption of clean energy technologies. The environmental benefits extend beyond emissions reduction to include job creation and decreased fossil fuel dependence.

Successful FIT programs require careful calibration to account for technological evolution and production cost fluctuations. When properly structured, these tariffs can sustain long-term renewable energy growth while adapting to changing market conditions.

Tax Incentives and Deductions

Strategic tax policies serve as powerful levers for directing investment capital. Governments can design targeted credits, exemptions, or deductions to stimulate growth in specific sectors like green technology or infrastructure. These fiscal tools don't just reduce investor burdens - they actively shape regional economic landscapes by attracting business concentrations to areas with favorable tax regimes.

Government Guarantees and Loan Programs

By assuming partial risk through guarantees and specialized loan programs, governments can unlock capital for projects that might otherwise struggle for funding. This proves especially crucial for startups and small enterprises that face barriers to traditional financing. Such programs not only support individual businesses but also cultivate broader entrepreneurial ecosystems.

Risk Mitigation Strategies for Investors

Investor confidence hinges on stable legal frameworks and transparent governance structures. Clear dispute resolution mechanisms and consistent regulatory enforcement significantly lower perceived risks, particularly for foreign capital. When investors see robust protections against arbitrary policy changes, they're more likely to commit to long-term projects.

Public-Private Partnerships (PPPs)

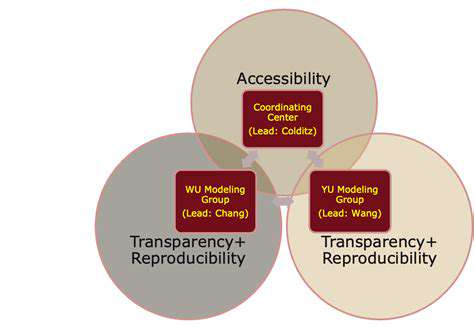

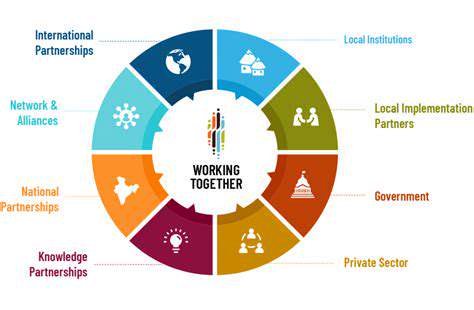

PPPs merge public oversight with private sector efficiency to tackle large-scale projects neither could achieve alone. The success formula includes transparent contracting, measurable performance benchmarks, and reliable conflict resolution processes. These collaborations demonstrate how shared risk can yield greater collective benefits than isolated efforts.

When marine mammals strand or become injured, response teams operate with military-grade precision and urgency. Their coordinated efforts combine veterinary expertise with field experience to maximize survival rates, proving that preparation and rapid response can change ecological outcomes.

The Role of Public Awareness and Education: Fostering Public Support

The Importance of Education Campaigns in Shaping Public Perception

Well-designed education initiatives transform public understanding of complex issues through myth-busting and factual clarity. Multi-platform outreach - spanning social media, community events, and traditional media - ensures messages resonate across demographic divides. The most successful campaigns create informed citizens who actively participate in societal progress.

The Role of Policy and Legislation in Enhancing Public Awareness

Legislative mandates turn awareness programs from optional activities into institutional requirements. When policies allocate dedicated resources and funding, they create sustainable frameworks for public education that transcend political cycles. This legal infrastructure enables continuous improvement of citizen engagement strategies at scale.