Microgrid Energy Storage Design

Choosing the Right Energy Storage Technology

Understanding Your Energy Needs

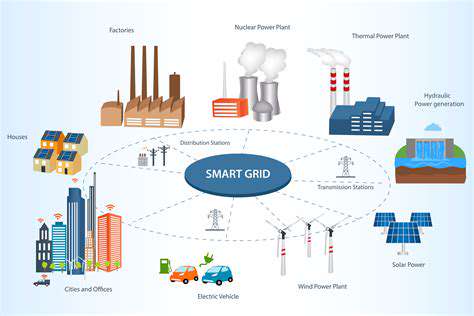

Selecting an appropriate energy storage solution plays a pivotal role in optimizing efficiency while keeping costs manageable across various applications. Gaining deep insight into your energy requirements forms the foundation of this process. This requires examining peak energy usage periods, accounting for fluctuations in renewable sources such as solar and wind power, and forecasting future energy demands. When these elements receive proper attention, you can choose a system that consistently delivers what you need, avoiding both wasteful overspending and disappointing underperformance. An adequately sized energy storage setup can dramatically decrease dependence on traditional grid power, resulting in significant savings over time.

Several variables influence overall energy needs, including the number of users, typical consumption patterns, and the specific equipment being powered. For instance, a home with several electric vehicles will have vastly different requirements compared to a small office primarily running computers and lights. Pinpointing these needs with accuracy enables the selection of an energy storage system with the ideal capacity and technology for your circumstances, preventing problems caused by inadequate or excessive storage capabilities.

Evaluating Different Storage Technologies

The market offers diverse energy storage options, each with distinct features and advantages. Lithium-ion batteries remain a common selection thanks to their impressive energy density and relatively lengthy service life. However, considerations like price, environmental consequences, and possible safety issues must also factor into the decision. Alternative solutions such as flow batteries or pumped hydro storage could prove more appropriate for large-scale implementations or particular geographic settings. A thorough comparison of available technologies is indispensable for identifying the optimal choice.

Service life and maintenance demands represent equally important considerations when examining storage technologies. Some systems need more frequent upkeep or part replacements than others. Recognizing these potential expenses and service intervals is vital for effective long-term planning. Additionally, evaluating the environmental footprint of potential solutions constitutes a critical component of the selection process, as ecological impacts vary widely between different storage methods.

Considering Cost and Return on Investment

While the purchase price of an energy storage system carries substantial weight in any decision, it's essential to look beyond initial expenses and examine long-term financial returns. This includes assessing possible reductions in electricity bills, decreased grid dependence, and opportunities to sell surplus energy back to utility providers. Examining these aspects enables a clear determination of the investment's financial feasibility over an appropriate time horizon.

Ongoing operational costs - including routine maintenance, potential repairs, and component replacements - should also contribute to the complete financial picture. Weighing these factors against expected savings guarantees a balanced and practical evaluation of the investment's profitability. This approach supports informed decision-making aligned with both financial objectives and long-term energy requirements.

Cost-Benefit Analysis and Return on Investment (ROI)

Understanding Cost-Benefit Analysis

Performing a detailed cost-benefit analysis represents a critical component of microgrid energy storage planning. This process entails carefully examining upfront capital expenditures for the storage system, including battery purchases, inverters, and other essential equipment. It also accounts for continuing operational costs like maintenance, possible replacements, and electricity usage during charging and discharging cycles. This comprehensive evaluation should be balanced against projected long-term advantages, which may include reduced grid dependence, lower utility expenses, and potential income from energy trading or backup power provision.

Comprehending the nuances of cost-benefit analysis is fundamental. A properly conducted assessment accounts for all relevant elements, from the original investment to sustained operational expenses. This incorporates expected energy price variations, maintenance timelines, and potential technological developments that could influence the system's durability and performance.

Estimating Return on Investment (ROI)

Determining return on investment (ROI) proves essential for validating the economic justification of a microgrid energy storage installation. ROI is computed by dividing the net profit generated during a specified period by the initial investment amount. This calculation helps stakeholders evaluate potential financial gains and compare various storage alternatives. A higher ROI signifies a more appealing investment prospect. A complete ROI assessment should incorporate possible revenue streams from energy trading or backup power sales, along with anticipated energy cost reductions throughout the system's operational life.

Factors Affecting ROI in Microgrid Design

Multiple variables can substantially influence the ROI of a microgrid energy storage setup. These include regional energy price instability, the regularity and length of power outages, the expected load characteristics of the microgrid, and the particular technical attributes of the chosen storage technology. Changes in these parameters will modify the projected ROI, making sophisticated understanding of these factors crucial for sound decision-making.

For example, areas experiencing significant energy price volatility might demonstrate higher ROI potential compared to regions with stable pricing. Similarly, microgrids confronting frequent and extended grid disruptions will probably show more favorable ROI due to the enhanced reliability and resilience provided by energy storage capacity.

Analyzing Different Energy Storage Technologies

Multiple energy storage technologies exist, each presenting distinct cost structures and performance attributes. The selected technology profoundly impacts the complete cost-benefit analysis and ROI. Lithium-ion batteries, while commanding higher initial prices, typically deliver greater energy density and extended operational lifetimes relative to other options. These higher upfront costs might be balanced by lower maintenance needs and improved efficiency during the system's lifespan. Comparing various technological alternatives and their associated expenses is imperative for achieving maximum ROI.

Considering Operational and Maintenance Costs

Beyond the original investment, operational and maintenance expenses significantly affect the long-term economic viability of a microgrid energy storage installation. These costs encompass routine maintenance activities, possible battery replacements, and continuous electricity consumption for charging and discharging operations. Prudent consideration of these ongoing expenditures is necessary to prevent unforeseen financial strain. The analysis should account for projected equipment lifespan, required maintenance frequency, and potential repair or replacement costs.

A robust cost-benefit examination must include a transparent itemization of these expenses and their expected effect on overall ROI. This meticulous methodology ensures a realistic appraisal of the investment and its extended financial consequences.