Investing in Distributed Energy Resources (DERs) and Virtual Power Plants (VPPs)

Policy tailwinds are accelerating adoption across markets. From feed-in tariffs in Germany to tax credits in the U.S., regulatory frameworks now actively reward DER deployment. Forward-thinking investors recognize these incentives aren't merely subsidies - they're structural realignments of energy economics. The German Energiewende and California's Self-Generation Incentive Program demonstrate how policy can create investable markets where none existed before.

Advantages of Virtual Power Plants (VPPs)

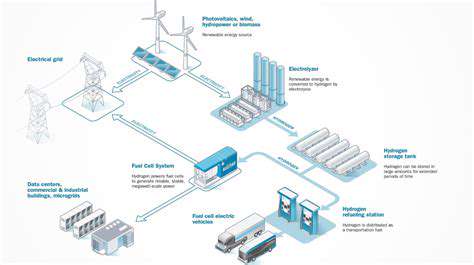

Virtual Power Plants represent the next evolution in energy asset optimization. By networking dispersed DERs into unified dispatchable resources, VPPs solve the intermittency challenge that plagues individual renewable installations. The true innovation lies in their dynamic load-balancing algorithms, which can respond to grid conditions faster than any traditional peaker plant.

Consider the Australian example: Tesla's Hornsdale Power Reserve VPP delivered AU$150 million in grid stabilization savings within its first two years. This exemplifies how software-defined energy assets can extract maximum value from physical infrastructure. For investors, this translates to higher capacity factors and revenue streams from multiple grid services markets.

Market Trends and Growth Potential

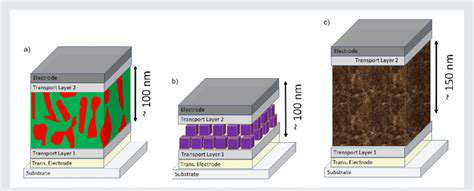

The DER sector is experiencing compound annual growth rates exceeding 16% globally, driven by three irreversible trends:

- Plummeting technology costs (solar PV modules down 82% since 2010)

- Advances in battery chemistry doubling energy density

- Digitalization enabling sophisticated asset aggregation

Emerging markets present particularly compelling opportunities. In Sub-Saharan Africa, DER microgrids are leapfrogging traditional grid development entirely. The International Energy Agency projects DERs will supply power to 60% of new African energy consumers by 2030 - a potential $120 billion investment opportunity.

Risk Assessment and Mitigation Strategies

While the sector offers attractive returns, prudent investors employ specific hedging strategies:

| Risk Factor | Mitigation Approach |

|---|---|

| Regulatory Uncertainty | Diversify across jurisdictions with established policy frameworks |

| Technology Obsolescence | Focus on modular systems with upgrade pathways |

| Offtake Volatility | Secure diversified revenue streams (capacity markets, ancillary services) |

The most successful investors treat DER portfolios like technology assets - constantly rebalancing to capture emerging opportunities while maintaining core positions in proven solutions. Active management outperforms passive holding in this rapidly evolving space.

When examining personalized learning systems, we see parallels with DER optimization. Both require adaptive algorithms that respond to unique patterns and behaviors. Just as machine learning tailors pet training, advanced analytics maximize DER performance.

Navigating the Challenges and Opportunities of DER Integration

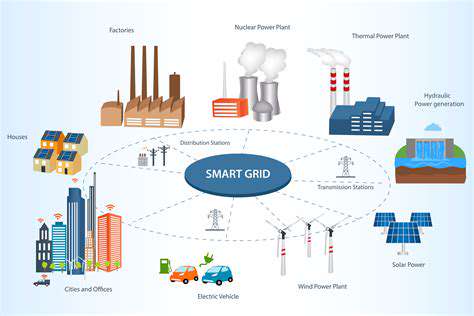

The New Energy Ecosystem

Grid operators now face a paradigm shift from centralized control to distributed coordination. This requires entirely new operational philosophies - what some call orchestration rather than command management. The transformation mirrors changes seen in telecommunications when cellular networks supplanted landline systems.

Technology Convergence Opportunities

Three technological vectors are converging to enable seamless DER integration:

- Edge computing for real-time local control

- Blockchain for transparent energy transactions

- AI for predictive maintenance and dispatch

Early adopters combining these technologies achieve 20-30% higher asset utilization than peers relying on legacy systems.

Workforce Transformation

The skills required for energy professionals are evolving rapidly. Traditional line workers now need digital competencies, while data scientists must understand grid physics. Leading utilities address this through:

- Partnerships with technical colleges

- Augmented reality training systems

- Knowledge transfer programs

The human element remains critical even in highly automated systems - a lesson learned from early DER integration missteps.

Regulatory Innovation

Progressive regulators are piloting groundbreaking approaches:

- New York's Reforming the Energy Vision (REV) initiative

- UK's RIIO-2 framework rewarding innovation

- Singapore's sandbox for energy-as-a-service models

These demonstrate how policy innovation can accelerate technological adoption while protecting consumer interests.

Customer-Centric Models

The most successful DER integrators adopt a service mindset. Examples include:

- Sunrun's energy subscription model

- Sonnen's community energy sharing

- LO3 Energy's local marketplace

These approaches recognize that energy consumers are becoming prosumers - simultaneously producing and consuming power.