The Regulatory Challenges of Decentralization of Energy Generation

Intermittency's Impact on Grid Reliability

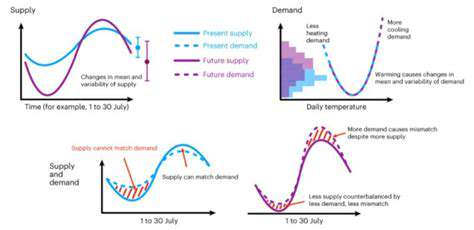

Intermittency, a key characteristic of renewable energy sources like solar and wind, poses significant challenges to the stability of the electrical grid. The fluctuating nature of these sources means that power generation can vary dramatically, requiring sophisticated management systems to maintain a consistent and reliable supply. This variability necessitates grid operators to constantly adapt and adjust their strategies to accommodate these changes, potentially leading to higher operational costs and increased complexity.

Furthermore, the unpredictable nature of intermittent energy sources can create imbalances in supply and demand, potentially leading to grid instability. This can manifest as voltage fluctuations, frequency deviations, and even complete grid failures in extreme cases. Addressing this requires innovative solutions that can effectively integrate and manage these intermittent sources into the existing grid infrastructure.

Managing Fluctuations in Renewable Energy Production

Grid operators must develop strategies to effectively manage the fluctuations in renewable energy production. This includes employing advanced forecasting techniques to predict energy output, optimizing storage solutions to smooth out peaks and valleys, and implementing intelligent control systems to dynamically adjust power generation from other sources.

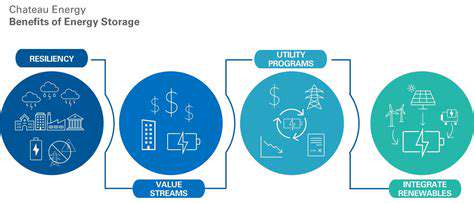

Importance of Energy Storage Solutions

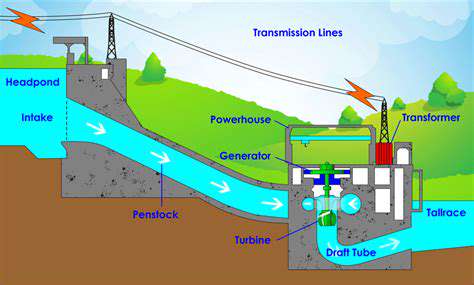

Energy storage technologies play a crucial role in mitigating the impact of intermittency. Batteries, pumped hydro, and other storage solutions can store excess energy generated during periods of high renewable energy production and release it when needed, thereby stabilizing the grid during periods of low generation.

The development and deployment of cost-effective and scalable energy storage solutions are vital to the successful integration of intermittent renewable energy sources into the grid. This is a significant area of research and investment.

Grid Infrastructure Upgrades for Intermittency

Adapting existing grid infrastructure to accommodate intermittent energy sources necessitates upgrades. This may involve reinforcing transmission lines to handle fluctuating power flows, installing smart grids with advanced monitoring and control capabilities, and implementing distributed generation systems to improve local grid stability.

Advanced Forecasting and Control Systems

Accurate forecasting of renewable energy production is essential for effective grid management. Advanced forecasting models, combined with sophisticated control systems, allow grid operators to anticipate fluctuations and proactively adjust power generation from conventional sources or other renewable energy sources. This predictive capability is fundamental to ensuring grid stability in the presence of intermittent energy.

Demand-Side Management and Load Balancing

Enhancing demand-side management, such as through smart appliances and energy efficiency programs, can help balance fluctuating energy supply. This involves encouraging consumers to adjust their energy consumption patterns in response to grid conditions, thereby reducing the strain on the grid during periods of low renewable energy generation. Such strategies are crucial for integrating intermittent energy sources while maintaining grid stability.

International Collaboration and Standards

Addressing the challenges of intermittency requires international collaboration and the development of standardized methodologies for grid operation and integration of renewable energy sources. This includes sharing best practices, conducting joint research, and establishing common standards for interoperability and grid security. Strong international cooperation will be critical to overcoming the hurdles associated with large-scale integration of intermittent renewable energy.

While harnessing gravity for energy generation has traditionally been less successful than other renewable energy sources, some innovative concepts are emerging. Ideas like energy storage systems utilizing gravity-based potential energy are being explored. These systems are designed to store energy by lifting heavy weights, and converting this potential energy back into electricity when needed. Further development and research into this area are likely to yield more practical applications in the future.

Ownership Models and Regulatory Oversight: Defining Clear Roles

Ownership Models for Digital Assets

Understanding the various ownership models for digital assets is crucial for navigating the complexities of the digital economy. Different models, such as centralized, decentralized, and hybrid approaches, dictate how ownership rights are structured, managed, and transferred. Each model presents unique advantages and disadvantages in terms of security, accessibility, and control. Furthermore, these models significantly impact the potential for fraud and disputes.

Centralized models, often associated with traditional financial institutions, offer a degree of regulatory oversight and established legal frameworks. However, they may not always provide the same level of transparency and user control as decentralized models. Understanding these nuances is essential for making informed decisions about where to store and manage digital assets.

Regulatory Overviews and Implications

Regulatory frameworks surrounding digital assets are still evolving globally, leading to a complex and dynamic landscape. Governments worldwide are grappling with the challenges of regulating emerging technologies, balancing innovation with consumer protection and market stability. This ongoing evolution creates uncertainty for businesses and individuals alike, requiring careful consideration of the specific rules and regulations in each jurisdiction.

Different jurisdictions have adopted various approaches to regulating digital assets, ranging from outright prohibitions to comprehensive licensing regimes. Understanding these varying approaches is essential for businesses operating in multiple markets. This understanding is vital for mitigating potential legal and financial risks.

Impact on Financial Markets

The introduction of digital assets and alternative ownership models has significantly impacted traditional financial markets. These newer assets often offer unique investment opportunities and potential returns, but they also pose new risks and challenges that need careful consideration. Investors need to understand the risks involved in investing in assets without established legal precedents, and the potential for volatility.

The integration of digital assets into traditional finance is a rapidly evolving field, creating opportunities for innovation and growth while simultaneously presenting challenges for regulatory frameworks and market stability. This evolution requires careful consideration of the potential impact on existing financial institutions and the development of new regulatory mechanisms to ensure market integrity.

Global Regulatory Landscape

The global regulatory landscape for digital assets is characterized by a patchwork of regulations, creating a complex and fragmented environment. Different countries and regions have different approaches to regulating digital assets, leading to inconsistencies and challenges for businesses operating internationally. This presents unique challenges, especially for companies looking to expand their operations across borders.

Harmonization of global regulations is crucial to foster a more stable and predictable environment for digital asset businesses and investors. Lack of harmonization can hinder the growth and adoption of digital assets, and lead to increased regulatory uncertainty.