Sustainable Supply Chain Finance for Renewable Energy

The renewable energy sector is experiencing unprecedented growth, driven by the urgent need to transition to cleaner energy sources. However, this rapid expansion faces significant challenges, particularly in the area of financing. Sustainable supply chain finance plays a crucial role in addressing these challenges by providing a mechanism for financing the entire lifecycle of renewable energy projects, from raw materials acquisition to final product installation. This innovative approach not only accelerates the deployment of renewables but also fosters a more resilient and sustainable supply chain.

Streamlining Financing for Renewable Energy Materials

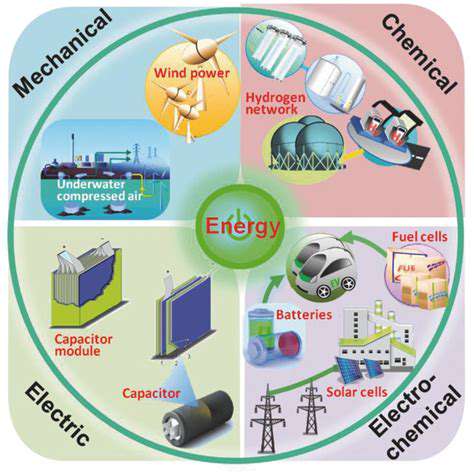

A significant hurdle in renewable energy project development is the often-complex and lengthy process of securing financing for raw materials. Sustainable supply chain finance can directly address this by facilitating access to capital for producers of materials like solar panels, wind turbine components, and batteries. This streamlined approach allows these crucial suppliers to maintain production levels, ensuring a steady flow of materials for project development and ultimately reducing project timelines and costs.

By providing financing that aligns with sustainable practices, this approach fosters responsible sourcing and reduces environmental impact throughout the supply chain, from mining to manufacturing.

Improving Transparency and Traceability in Supply Chains

Sustainable supply chain finance inherently promotes transparency and traceability. The financing mechanisms often require detailed documentation on the environmental impact and social responsibility measures undertaken by suppliers. This fosters accountability and allows stakeholders to track the origin and treatment of materials throughout the supply chain, from the extraction of raw materials to the final product. This level of transparency is critical in building consumer trust and ensuring that renewable energy projects are developed ethically and sustainably.

Enhancing Financial Resilience for Renewable Energy Businesses

The renewable energy sector is comprised of a diverse range of businesses, from small-scale installers to large-scale project developers. Sustainable supply chain finance can provide tailored financing solutions that meet the specific needs of each business segment. This individualized approach strengthens the overall resilience of the sector by reducing financial risks and providing access to capital for businesses that might otherwise struggle to secure funding. This is particularly important for smaller companies that often face challenges in accessing traditional financing options.

Promoting Responsible Practices and Environmental Sustainability

A core tenet of sustainable supply chain finance is its ability to promote responsible practices and environmental sustainability throughout the entire supply chain. By prioritizing suppliers who adhere to environmentally friendly standards and social responsibility initiatives, this approach fosters a culture of sustainability. This includes promoting ethical labor practices, minimizing waste, and reducing the environmental footprint of all stages of renewable energy project development. This comprehensive approach ensures that renewable energy projects contribute to a more sustainable future, not just in terms of energy production but also in terms of environmental and social impact throughout the entire supply chain.

Unlocking Capital for Renewable Energy Projects via Sustainable Finance Mechanisms

Sustainable Finance: A Catalyst for Renewable Energy

Sustainable finance mechanisms are crucial for unlocking capital for renewable energy projects. These innovative financial instruments prioritize environmental, social, and governance (ESG) factors, directing investment towards projects with demonstrably positive impacts. By integrating environmental considerations into traditional financial models, sustainable finance allows for a more holistic assessment of project viability, going beyond simple return on investment metrics. This approach recognizes the long-term value proposition of renewable energy, including its contribution to a healthier planet and a more resilient economy. Furthermore, sustainable finance encourages the development of robust and transparent reporting frameworks, enabling investors to track the environmental and social performance of projects over time.

The growing demand for renewable energy sources, coupled with the need to mitigate climate change, necessitates a shift towards sustainable finance. This shift is not just about finding new sources of capital; it's about re-imagining how capital is allocated, prioritizing projects that align with sustainability goals. This involves innovative approaches like green bonds, which specifically channel investments towards environmentally friendly initiatives, and impact investing, which focuses on generating both financial returns and positive social and environmental outcomes. These instruments are not only attracting significant investment but also driving innovation in the renewable energy sector by creating a market for green technologies and sustainable practices.

Attracting Investment through Transparency and Risk Mitigation

Transparency and risk mitigation are paramount in attracting investment for renewable energy projects. Investors require detailed and verifiable information about the environmental impact, social responsibility, and financial viability of a project. Strong project due diligence, comprehensive environmental assessments, and robust reporting mechanisms are essential for building investor confidence. This includes the use of standardized metrics and reporting standards to ensure consistent and comparable data across projects, fostering trust and predictability in the renewable energy sector.

Moreover, effectively mitigating project risks is critical. This involves identifying and assessing potential challenges, such as regulatory uncertainties, technological uncertainties, and market volatility. Comprehensive risk assessment models, incorporating a variety of scenarios and potential disruptions, are crucial for ensuring investor confidence and project sustainability. By clearly outlining and addressing potential risks, projects can demonstrate their resilience and attract investment capital from a wider range of sources, including institutional investors and private equity funds.

The development of robust risk management frameworks is not only crucial for attracting investment but also for ensuring the long-term success and sustainability of renewable energy projects. These frameworks should encompass a wide range of potential risks, enabling proactive mitigation strategies. This holistic approach to risk management builds investor confidence and enhances the overall attractiveness of renewable energy investments.

Finally, strong governance structures are essential for ensuring accountability, transparency, and ethical conduct throughout the project lifecycle. This includes robust internal controls, clear lines of communication, and established mechanisms for stakeholder engagement. Investor confidence in the governance of a project is directly linked to the attractiveness of the investment opportunity.

Addressing these factors fosters trust and encourages broader participation in the renewable energy sector, accelerating the transition to a sustainable future.