Corporate Renewable Procurement for Office Buildings

Geothermal energy, harnessed from the Earth's internal heat, offers a unique and reliable renewable energy source. Using heat from deep within the Earth to generate electricity or directly heat buildings, geothermal energy is a sustainable alternative to fossil fuels. Exploring and developing geothermal resources can contribute to the global transition to clean energy sources.

Geothermal energy is particularly suitable for certain geographic regions. The availability of geothermal resources varies significantly, limiting its potential in some areas. However, geothermal energy has the potential to be a significant player in the renewable energy sector, especially in specific locations.

Bioenergy: Utilizing Organic Matter

Bioenergy, derived from organic matter, presents a versatile renewable energy source. Biomass, which encompasses agricultural residues, wood, and other organic materials, can be converted into biofuels and used to generate electricity. Bioenergy systems can offer a sustainable solution for energy needs in rural communities, reducing dependence on fossil fuels.

The sustainability of bioenergy production is contingent upon responsible resource management and minimizing environmental impacts. Careful consideration of land use, waste management, and potential effects on food security are essential for the long-term viability of bioenergy initiatives.

Negotiating and Securing Renewable Energy Contracts

Understanding the Renewable Energy Landscape

Navigating the renewable energy sector requires a deep understanding of the current market dynamics, technological advancements, and government policies. This landscape is constantly evolving, demanding a flexible and adaptable approach to negotiation. Understanding the specific regulations and incentives available for renewable energy projects in a given region is crucial for securing favorable terms.

Identifying Potential Partners and Investors

Successful negotiation hinges on identifying reputable and financially sound partners. Thorough due diligence is essential to assess the credibility and capacity of potential investors and developers. Identifying partners with a shared vision and a strong track record in renewable energy projects is key to a successful outcome.

Developing a Robust Financial Strategy

A well-defined financial strategy is paramount to securing financing for renewable energy projects. This includes meticulous cost analysis, realistic projections of project returns, and exploring various financing options. A clear understanding of potential risks and mitigation strategies is crucial for securing favorable financing terms and managing project costs effectively.

Crafting a Compelling Project Proposal

A comprehensive project proposal is essential for attracting investors and securing funding. This document should clearly outline the project's scope, objectives, technical specifications, anticipated costs, and projected returns. A well-structured proposal demonstrates a clear understanding of the project and its potential for success, enhancing the chances of securing investment.

Negotiating Key Contractual Terms

Negotiating favorable contractual terms is a critical aspect of securing renewable energy projects. This includes addressing aspects such as project timelines, responsibilities, risk allocation, and dispute resolution mechanisms. Careful consideration of all potential contingencies is crucial for ensuring a mutually beneficial agreement and protecting the interests of all parties involved.

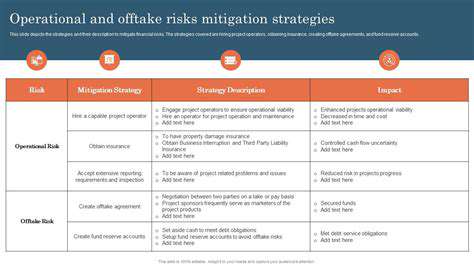

Managing Risk and Potential Challenges

Renewable energy projects are subject to various risks, including fluctuating energy prices, technological advancements, regulatory changes, and supply chain disruptions. A comprehensive risk assessment and mitigation strategy is essential to navigate these challenges. Developing contingency plans for unforeseen circumstances is vital for maintaining project stability and profitability.

Securing Permits and Approvals

Obtaining necessary permits and approvals is a crucial step in the process of implementing a renewable energy project. The process can be complex and time-consuming, requiring meticulous attention to detail and adherence to local regulations. A thorough understanding of the permitting process and proactive communication with relevant authorities are critical to expediting the approval process.

Profitability is a cornerstone of economic viability, measuring the success of a business in generating revenue above its costs. Key profitability metrics include gross profit margin, operating profit margin, and net profit margin. Each metric provides a different lens through which to view the financial health of an organization. Understanding these figures allows for strategic decision-making regarding pricing, cost optimization, and overall operational efficiency. Analyzing trends in these metrics over time is crucial for identifying patterns and making informed projections about future performance.