Overcoming Policy Hurdles for Decentralization of Energy Generation

Incentivizing Investment and Innovation

Incentivizing Investment

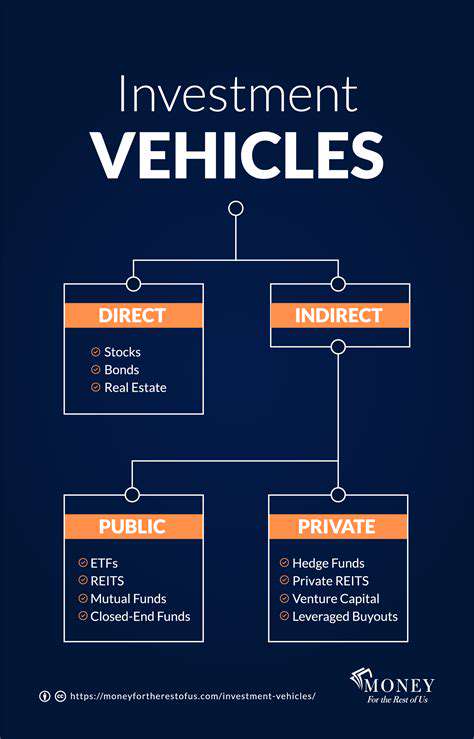

Encouraging investment in decentralized technologies requires a multifaceted approach that goes beyond simply removing regulatory barriers. Incentivizing investment involves crafting policies that attract capital, foster risk-taking, and reward innovation. This includes tax breaks, grants, and other financial incentives targeted at startups and established firms developing decentralized applications (dApps) and infrastructure. Clear, predictable regulatory frameworks are also crucial to provide investors with confidence and reduce uncertainty.

Furthermore, establishing robust venture capital ecosystems and fostering collaborations between governments, research institutions, and private sector actors can significantly boost investment in decentralized projects. The potential for significant returns in this emerging sector, coupled with a supportive policy environment, can attract both domestic and international investment.

Promoting Innovation

Innovation is the lifeblood of decentralization. To encourage innovation, policymakers need to create an environment that fosters experimentation and risk-taking. This involves minimizing regulatory burdens while simultaneously ensuring that new technologies are developed responsibly and ethically. Clear guidelines on data privacy, security, and intellectual property rights are essential to encourage developers to build cutting-edge solutions.

Supporting the development of open-source platforms and collaborative projects can facilitate the rapid advancement of decentralized technologies. Providing access to resources, such as funding, mentorship programs, and networking opportunities, can further boost the innovation pipeline.

Streamlining Regulatory Processes

One of the most significant challenges to investment and innovation in decentralized technologies is the lack of clear and consistent regulatory frameworks. Ambiguous or overly restrictive regulations can deter both developers and investors, hindering the growth of the sector. Policymakers should strive for a regulatory approach that is adaptable to the rapidly evolving nature of decentralized technologies while safeguarding against potential risks.

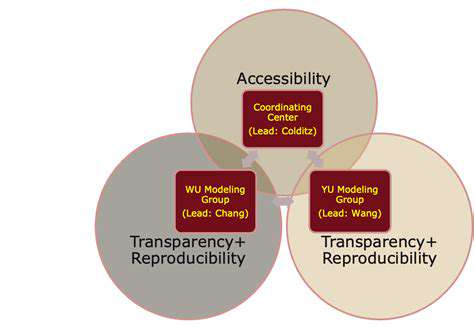

Fostering Collaboration

Decentralized technologies are not developed in a vacuum. Collaboration between different stakeholders is crucial for their success. This includes collaboration between governments, industry leaders, researchers, and civil society organizations. Shared knowledge, best practices, and a unified approach to addressing challenges can accelerate innovation and deployment.

Addressing Security Concerns

Security is paramount in the decentralized space. Policymakers need to address the unique security challenges presented by decentralized systems. This includes fostering research and development in security protocols, supporting the development of robust security standards, and promoting the adoption of best practices for securing decentralized applications and infrastructure. Educating the public about the risks and benefits of decentralized technologies is also crucial.

Ensuring Ethical Development

The ethical implications of decentralized technologies are of paramount importance. Policymakers must proactively address concerns regarding data privacy, algorithmic bias, and the potential for misuse. Promoting ethical guidelines and standards for the development and deployment of decentralized technologies is crucial to ensure that these innovations benefit all members of society. This includes promoting transparency and accountability in the decentralized ecosystem.

Building Public Trust

Public trust is essential for the long-term success of decentralized technologies. Policymakers should work to educate the public about the benefits and potential risks of these technologies. Promoting transparency and accountability in the decentralized ecosystem, fostering open dialogue, and addressing public concerns are all critical to building public trust in decentralized technologies. Education and clear communication can help dispel misinformation and promote a better understanding of the potential of this innovative space.

Promoting Public-Private Partnerships and Knowledge Sharing

Understanding Public-Private Partnerships

Public-private partnerships (PPPs) represent a collaborative approach where public sector organizations and private sector entities work together to achieve shared goals. These partnerships are crucial for projects that demand significant capital investment, specialized expertise, or innovative solutions. Understanding the nuances of these partnerships is essential for maximizing their effectiveness. PPPs can encompass a wide range of projects, from infrastructure development to healthcare delivery and social services.

A key aspect of PPPs is the clear delineation of roles and responsibilities between the public and private sectors. This collaborative structure allows each party to leverage their respective strengths, ultimately leading to more efficient and effective outcomes. Careful planning and robust governance structures are fundamental to the success of these partnerships.

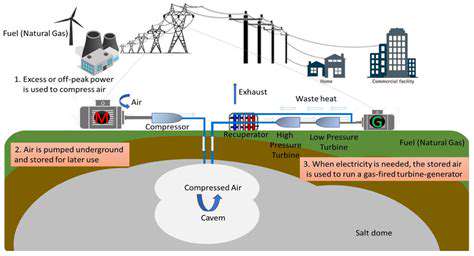

Benefits of PPPs for Infrastructure Development

Infrastructure projects, often requiring substantial funding and technical expertise, are well-suited for PPPs. These collaborations can accelerate project timelines, reduce public sector financial burdens, and attract private sector investment. This can lead to improved infrastructure quality and greater public access to essential services.

Private sector involvement often brings innovative solutions and cost-effective construction methods, leading to long-term value for the public sector. This is particularly important for projects with complex technical requirements or stringent timelines. Further, PPPs can foster technological advancements in infrastructure.

Risk Management in PPPs

Successful PPPs require meticulous risk assessment and mitigation strategies. Potential risks include fluctuating market conditions, changes in government regulations, and unforeseen technical challenges. Effective risk management is crucial for mitigating potential financial and operational uncertainties.

Comprehensive contracts and clear dispute resolution mechanisms are essential components of mitigating risks. Robust due diligence processes should be implemented to identify and address potential issues before project commencement. Transparency and clear communication are also pivotal to maintaining trust and resolving disputes effectively.

Financial Considerations in PPPs

Careful financial analysis is critical to the success of a PPP. This involves evaluating the project's financial viability, including the projected costs, revenues, and potential returns on investment for both parties. Accurate financial projections are essential for securing funding and maintaining financial stability throughout the project lifecycle.

Long-term financing strategies are crucial for PPPs. This includes exploring various funding options, such as government guarantees, private debt financing, and public-private equity investments. Understanding the specific financial requirements of each project is paramount for attracting suitable private sector partners.

Public-Private Partnerships in Healthcare

PPPs are increasingly being used in the healthcare sector to address challenges in service delivery and resource allocation. These partnerships can lead to improved access to healthcare services, especially in underserved communities. This collaborative approach allows for the integration of private sector expertise in areas such as technology and management.

Innovative healthcare models, such as community health centers or specialized clinics, can benefit from PPPs. These partnerships enable the provision of quality healthcare services in a more cost-effective manner. Public-private partnerships can promote efficiency and effectiveness in healthcare delivery.

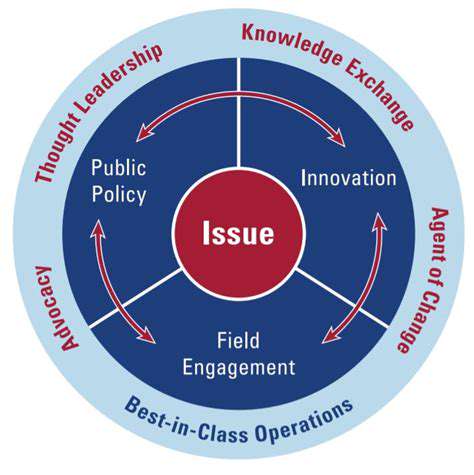

Governance and Transparency in PPPs

Strong governance structures are essential for effective PPPs, ensuring accountability and transparency. Clear roles and responsibilities, comprehensive contracts, and effective dispute resolution mechanisms are integral parts of these structures. Establishing clear lines of communication and shared goals fosters a collaborative environment that drives success.

Public scrutiny and oversight are essential for maintaining accountability and transparency in PPPs. Independent audits and regular reporting mechanisms can help ensure that the partnership operates in the best interest of all stakeholders. Transparency creates trust and accountability within the partnership.