Diversifying Your Portfolio with Renewable Energy Assets

Investing in a Sustainable Future

Renewable energy investments are no longer a niche pursuit but a crucial component of a diversified portfolio. The transition away from fossil fuels is accelerating, creating significant opportunities for investors to profit from the growth of solar, wind, and other clean energy technologies. This shift presents a unique investment landscape where long-term sustainability meets tangible financial returns, offering a positive impact alongside potential gains.

The Growing Demand for Clean Energy

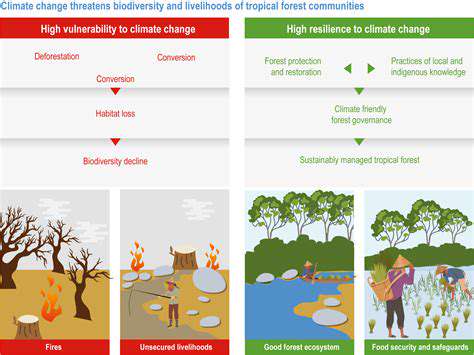

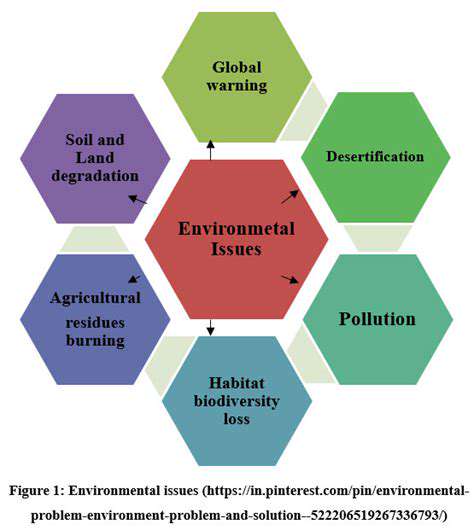

Global awareness of climate change and the need for sustainable practices is driving unprecedented demand for renewable energy sources. Governments worldwide are implementing policies encouraging renewable energy adoption, creating a supportive regulatory environment for investors. This surge in demand translates to increased production, lower costs, and greater market penetration, making it a compelling investment area.

This increasing demand is not just theoretical; it's reflected in tangible infrastructure projects and growing consumer acceptance of renewable energy products. This creates a positive feedback loop, further fueling the sector's growth.

Attractive Financial Returns

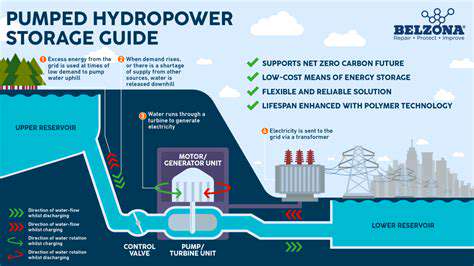

Renewable energy projects, while sometimes requiring upfront capital investment, often yield attractive financial returns over time. The long-term nature of these investments, coupled with the potential for strong growth, aligns well with a diversified portfolio strategy. Furthermore, the stability and predictable nature of some renewable energy sources, like hydro or geothermal, can provide a degree of portfolio diversification and resilience.

Diversification Beyond Traditional Assets

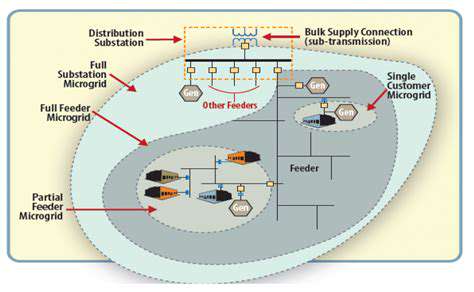

Incorporating renewable energy investments into your portfolio provides diversification beyond traditional asset classes like stocks and bonds. This diversification reduces overall portfolio risk by exposing you to different market forces and technological advancements. The unique characteristics of renewable energy investments offer a compelling opportunity to enhance your portfolio's resilience and potential returns.

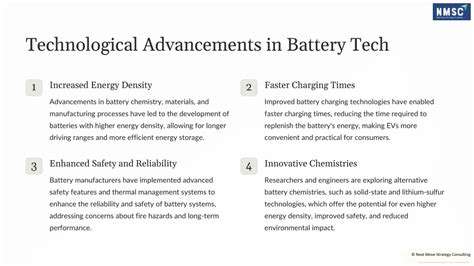

Technological Advancements and Innovation

The renewable energy sector is experiencing rapid technological advancements, leading to increased efficiency and reduced costs. These innovations are constantly pushing the boundaries of what's possible in terms of energy generation and storage. Investors can capitalize on these advancements by identifying companies and projects that are at the forefront of these innovations. This can lead to potentially high returns while contributing to a cleaner energy future.

Long-Term Sustainability and Societal Impact

Beyond the financial aspects, renewable energy investments contribute to a more sustainable future. Supporting these projects aligns with a growing societal demand for environmentally conscious investments. Choosing companies and projects involved in renewable energy can provide a sense of purpose and contribute to a positive impact on the planet. This long-term sustainability aspect of renewable energy investments makes them an increasingly important consideration for responsible investors.

Exploring Diverse Renewable Energy Asset Classes

Solar Power

Solar photovoltaic (PV) systems have become increasingly popular as a renewable energy asset class, offering attractive returns and a relatively low barrier to entry. Investing in solar farms, or participating in community solar projects, provides exposure to the growing demand for clean energy. This sector benefits from government incentives and supportive policies in many regions, leading to stable and predictable revenue streams for investors. Furthermore, the declining costs of solar technology are making it an even more compelling investment opportunity.

The long-term potential for solar energy is substantial, driven by the transition to cleaner energy sources worldwide. However, factors like land availability and permitting processes can influence the profitability of individual solar projects. Thorough due diligence and careful selection of projects are crucial for maximizing returns and minimizing risks.

Wind Energy

Wind energy, particularly onshore wind farms, is another established renewable energy asset class that presents attractive investment opportunities. The consistent availability of wind resources in many regions contributes to the predictable nature of these projects. Investing in wind projects often involves significant upfront capital, but the long-term revenue streams can be substantial. Understanding the local regulations and permitting processes is essential for successful investment in this area.

Offshore wind farms, while newer, are rapidly emerging as a key sector within the wind energy market. These projects often come with higher upfront costs but also promise higher returns due to stronger and more consistent wind speeds in offshore locations. However, the complexities of offshore construction and operation require careful consideration and detailed analysis before investment.

Hydropower

Hydropower, leveraging the power of water, presents a diverse range of investment opportunities, encompassing both established dams and newer small-scale hydro projects. Investing in established hydropower plants can provide a stable and reliable income stream. However, the environmental and societal impacts of hydropower projects need careful evaluation. Projects that incorporate sustainable practices and minimize environmental disruption are increasingly attractive to investors.

The potential for small-scale hydropower projects, often located in remote areas, offers the possibility of generating local energy and contributing to economic development in underserved communities. However, these projects are often subject to unique regulatory and permitting challenges, requiring thorough due diligence and a deep understanding of local conditions.

Biomass Energy

Biomass energy, derived from organic matter, offers a diverse range of investment opportunities. This sector encompasses projects utilizing agricultural waste, forestry residues, and other organic materials to generate energy. The sustainability of biomass projects depends heavily on the responsible sourcing and utilization of raw materials, minimizing environmental impact and maximizing the use of waste streams. Effective waste management is critical to the economic viability of these projects.

Different types of biomass, such as wood chips or municipal solid waste, offer varying levels of sustainability and environmental impact. Investors need to carefully consider the lifecycle of the raw materials and the environmental regulations governing the energy generation process. Detailed analysis is crucial to ensure that biomass projects align with sustainability goals and minimize negative environmental consequences.

Geothermal Energy

Geothermal energy, harnessing the Earth's internal heat, represents a potentially valuable renewable energy asset class. Investing in geothermal power plants requires a thorough understanding of the geological characteristics and availability of geothermal resources in specific locations. The location-specific nature of geothermal resources significantly impacts the profitability and feasibility of projects. Further, the initial capital expenditure for geothermal projects can be substantial, requiring careful assessment of the long-term returns.

The reliability and stability of geothermal energy production are significant advantages. However, the geological complexities and regulatory hurdles associated with geothermal projects need to be carefully evaluated. Investors should prioritize projects with well-established resources and sound permitting processes, maximizing returns and minimizing risk.

Virtual Reality (VR) technology offers a unique opportunity to immerse users in completely new and engaging environments. This immersion goes beyond simple visual stimulation; it encompasses all five senses, potentially creating a truly believable and interactive experience. By transporting individuals to different worlds, VR can revolutionize how we learn, play, and even interact with each other. Imagine exploring ancient ruins or soaring through the cosmos without leaving your living room – VR makes it possible.