Green Bonds and Sustainable Debt for Renewable Energy Projects

Attracting Institutional Investors and Private Capital

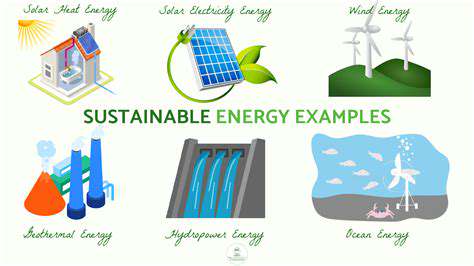

Understanding the Appeal of Green Bonds

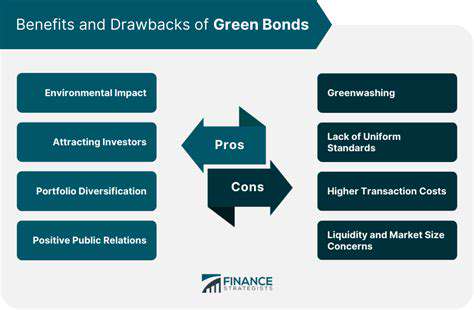

Green bonds, as a specific type of sustainable finance instrument, offer a unique investment opportunity for institutional investors and private capital. Their appeal lies in the potential for both financial returns and positive social and environmental impact. Investors are increasingly seeking investments that align with their values and contribute to a more sustainable future, making green bonds an attractive choice for those looking to generate returns while supporting environmentally friendly projects.

Beyond the ethical considerations, green bonds also present a unique risk-return profile. By focusing on projects with demonstrable environmental benefits, investors can potentially mitigate some of the risks associated with traditional investments while still achieving competitive returns. This is a critical factor for institutional investors seeking to diversify their portfolios while simultaneously contributing to environmental goals.

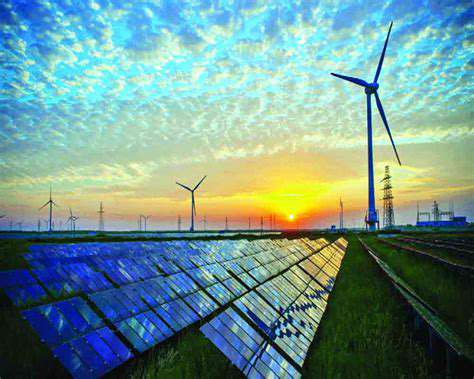

Identifying and Evaluating Green Projects

A key component of attracting institutional investors and private capital to green bonds is the meticulous identification and evaluation of eligible projects. This process involves rigorous due diligence to ensure the projects align with established environmental standards and criteria. Thorough assessments of project feasibility, environmental impact assessments, and financial viability are crucial for mitigating risks and maximizing returns.

Transparency and accountability are essential to build investor confidence. Clear and comprehensive reporting mechanisms are vital for tracking project progress and ensuring the environmental goals are met. This transparency allows investors to assess the true impact of their investments and maintain accountability for the projects.

The Role of ESG Factors in Investment Decisions

Environmental, Social, and Governance (ESG) factors are becoming increasingly important considerations in investment decisions, particularly for institutional investors and private capital. Green bonds, by their very nature, incorporate ESG principles, focusing on projects that promote environmental sustainability. This alignment with ESG criteria makes them attractive to investors who prioritize responsible investment.

Institutional investors are now actively seeking investments that not only generate returns but also contribute to a better world. Green bonds, with their focus on environmental projects, directly address these growing concerns and provide a pathway for investors to align their portfolios with their ESG values.

Structuring Green Bond Offerings for Maximum Impact

Effectively structuring green bond offerings is crucial for attracting both institutional investors and private capital. This involves presenting clear and compelling narratives about the project's environmental benefits and financial viability. Detailed and accessible information regarding the specific projects, their environmental impact, and potential returns is essential for attracting qualified investors.

Attracting Private Capital Through Innovative Models

Leveraging innovative financing models and partnerships can significantly enhance the attractiveness of green bonds to private capital. Collaborations between institutional investors, private equity firms, and green technology companies can unlock significant funding opportunities for impactful projects. This approach can create a virtuous cycle of investment, innovation, and environmental progress.

Creative funding structures, such as blended finance mechanisms, can further incentivize private capital participation by offering attractive risk-adjusted returns while supporting environmental objectives. This approach is vital for effectively mobilizing private capital for green projects.

Regulatory Frameworks and Standards for Green Bonds

Robust regulatory frameworks and standardized methodologies are essential to ensure the integrity and credibility of green bonds. Clear guidelines for project eligibility, reporting requirements, and verification processes are crucial for building investor confidence and mitigating greenwashing risks. International collaborations and standardized criteria will facilitate greater participation and ensure accountability.

Well-defined and transparent regulatory frameworks provide a stable and predictable environment for investors, encouraging broader participation in the green bond market. This fosters trust and confidence, leading to greater investment and a more sustainable future.